Practically 40 % of People have problem taking good care of a $400 emergency [source]. Maybe you’ve been there. Possibly you bought sick however couldn’t pay the invoice or afford the prescription. Did you ever need to experience your bike to work since you couldn’t afford to repair your automobile?

To beat sudden monetary hurdles, you want cash in financial savings. You could have at the very least 3 months value of bills within the financial institution. However, while you wrestle to seek out the money to make it via to the following payday or don’t have two nickels to rub collectively as a result of the automobile or pupil mortgage fee is increased than you’d like, simply fascinated about saving 3 months of bills is sufficient to make you are feeling anxious and powerless.

Belief me, there’s a mild on the finish of the tunnel. You may enhance your monetary state of affairs, when you do only one factor: Spend lower than you earn.

That’s your complete mission behind this publish. We wish to show you how to get monetary savings so you may construct up your financial savings. It’s straightforward. You may realistically add hundreds of {dollars} to your financial savings. However, it’s a must to act. All of it begins with a choice.

15 Cash Hacks to Develop Your Financial savings

1. Reduce Prices The place You Can

Chopping bills usually means chopping out the enjoyable stuff. What if I informed you there was a solution to lower bills robotically? Bought your consideration? Make investments just a few moments of your time to take a look at these apps and companies and see how one can begin saving cash at present.

Trim

Consider the Trim App as your automated private finance assistant. Tapping into AI, Trim will seek for alternatives to save lots of you cash in your cable and web payments, and month-to-month subscriptions. On high of that, Trim can even search for subscriptions you continue to pay for however won’t use any longer.

Simply join your checking accounts and bank cards, and it’ll scan them, on the lookout for recurring funds and ask you if you wish to cancel or negotiate a decrease charge.

Trim has already helped individuals save greater than $20 million. How a lot do you assume it’s going to prevent?

Discover out while you join Trim at present.

Stability Switch Credit score Playing cards

If in case you have bank card debt, it’s a wrestle to pay down. It’s due to the curiosity. Whenever you’re caught with a ten%+ rate of interest, turning into debt free is a sluggish boat to China. Let’s repair that…

Stability Switch Credit score Playing cards provide 0% curiosity for 12 to 18 months (precise charge is predicated in your credit score rating). Meaning for a complete yr, you might put cash in the direction of your debt and 0% would go in the direction of curiosity. It’s a possibility to pay down debt aggressively.

Stability switch bank cards provide you with a window of alternative. If you wish to pay down debt, take curiosity off the desk so to pay down debt as shortly (and with as little cash) as doable.

Discover a safe Stability Switch Credit score Card right here (search for 0% APR)

Much more sources that will help you get monetary savings

2. Obtain These 3 Money-Collectors

OK, you may have quite a few methods to chop bills, now let’s concentrate on rising your earnings with free cash. That’s proper, free cash for doing belongings you already do.

Listed below are our Prime 4 money-saving apps you should utilize to begin constructing cash-back rewards. Do your self a favor and use all of them along side one another to stack your rewards. That is like stacking coupons within the digital age. Let’s go:

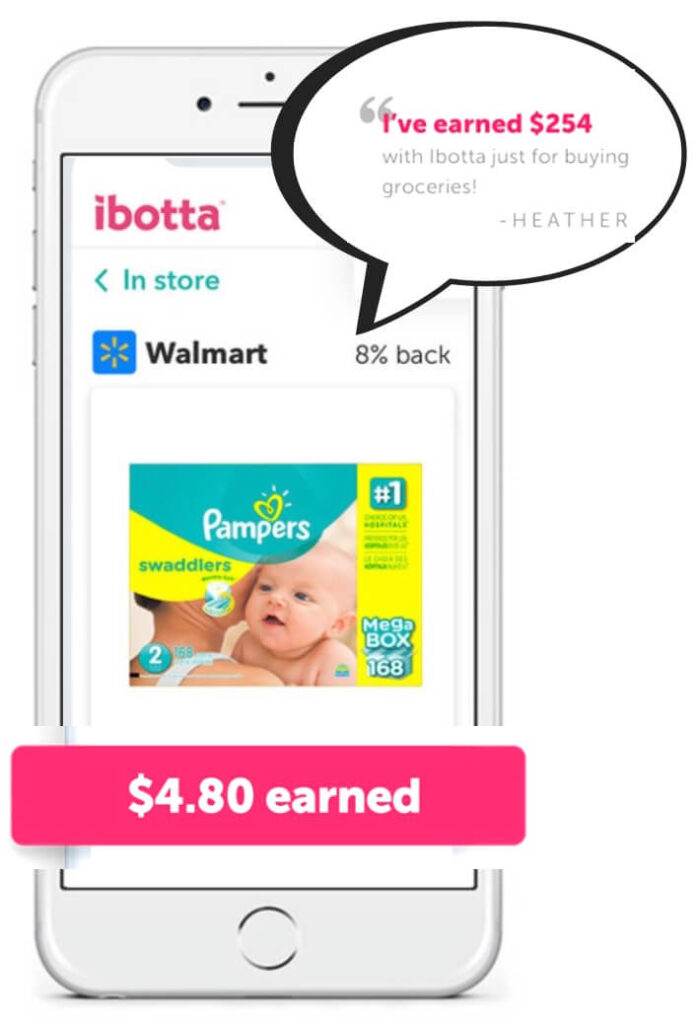

Ibotta ($20 Bonus)

The typical Ibotta shopper earns $150 a yr. If you happen to would relatively the grocery retailer preserve that cash, then do nothing. If you’d like what’s coming to you, obtain Ibotta.

Ibotta will get you cash-back on groceries. Whenever you obtain the app, activate your account, select the cash-back rewards out of your grocery retailer, use your app at take a look at, and watch your free cash develop.

Be ready to go in for what you want and chosen, and you’ll go away the shop with a smile in your face while you see how straightforward it’s to earn free money.

Ibotta is free to obtain plus you’ll get a $20 bonus while you declare your first free cash provide (inside 14 days)!

Need to hear much more methods Ibotta can prevent cash? Take a look at our Ibotta explainer video, right here!

So, when you like free cash… Obtain the Ibotta App right here and seize a free $20 reward card only for attempting it out!

Need all the Ibotta deets? Right here’s an in-depth evaluation of Ibotta we expect you’ll discover attention-grabbing.

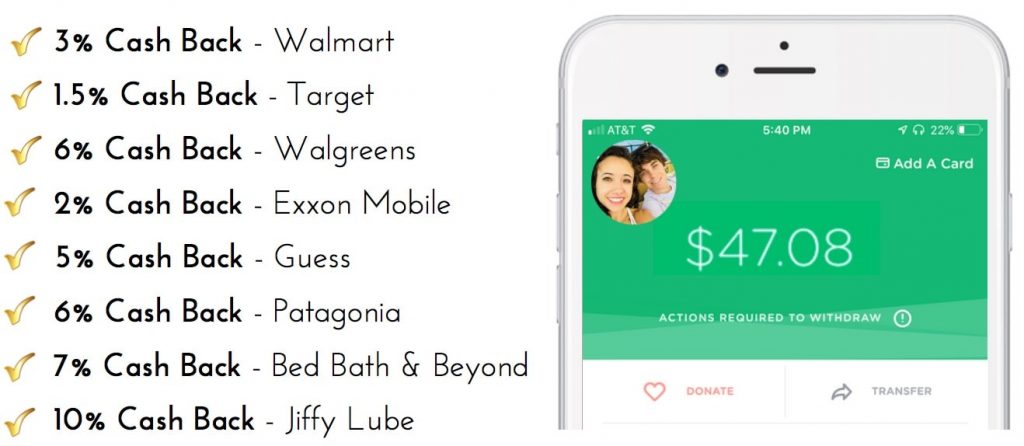

Dosh ($1 Bonus)

How does money again robotically sound to you? You’ll love utilizing the Dosh app as a result of it pays you in money, not factors. Hyperlink your credit score and debit playing cards, and earn money again while you purchase from the hundreds of Dosh affiliated shops, eating places, and on-line retailers:

- Walmart – 3% Money Again

- Goal – 1.5% Money Again

- Mattress Bathtub & Past – 7% Money Again

Get your first bonus by linking your first bank card, and luxuriate in how Dosh works robotically.

Obtain the free Dosh App now and seize a $1 welcome bonus.

We all know how vital cybersecurity is. Examine how Dosh is secure and safe, and likewise get the thin on the app by studying our Dosh evaluation.

Rakuten ($10 Bonus)

Whenever you set up the Rakuten (previously Ebates) Chrome (or Safari) browser “button”, it’s going to open up a world extensive net of money again potentialities. As you store on-line, if there is a chance to get some money again, the Rakuten button will provide you with a warning. Simply click on the button to activate the rewards.

Some offers are as much as 40 % money again. Set it and overlook it. Rakuten works on autopilot to get you free cash.

Enroll, save, and receives a commission with Rakuten (and seize your $10 bonus).

Have already got an Ebates/Rakuten account? Obtain the free Ebates/Rakuten browser button right here (accessible on Chrome and Safari) to begin saving cash on autopilot!

There may be a lot to love about this service, as you’ll study in our full Rakuten Evaluate.

Need much more money again alternatives?

> The 11 Finest Money Again Apps of 2020 <

3. Gather Free Cash with a Excessive Yield Financial savings Account

Are you leaving cash on the desk in terms of your financial savings account? Would you relatively earn 15X extra curiosity than what the everyday rate of interest pays? It’s inside attain while you deposit cash right into a excessive yield financial savings account. You’ll earn a better rate of interest.

The FDIC reported that the nationwide APY for a financial savings account was 0.09%. If you happen to had $1,000 deposited, you’d earn a whopping 90 cents per yr … lower than a buck.

APY refers to Annual Share Yield. The upper your financial institution’s APY, the extra free cash you get.

With a 1.55% APY:

- $1,000 in financial savings = $15.50 a yr in free cash.

- $5,000 in financial savings = $77.50 a yr in free cash.

- $15,000 in financial savings = $232.50 a yr in free cash.

What would occur when you didn’t take a couple of minutes to open an account with a excessive APY?

With a 0.09% APY:

- $1,000 deposited = $0.90 a yr in free cash.

- $5,000 in financial savings = $4.50 a yr in free cash.

- $15,000 in financial savings = $13.50 a yr in free cash… lower than what you’d make with simply $1,000 deposited with a high-yield financial savings account..

If you happen to blindly open a financial savings account, you’re leaving cash on the desk within the type of curiosity misplaced on a low APY.

Let’s treatment this. Select a financial institution with a excessive APY.

Finest Excessive-Yield Financial savings Accounts

CIT Financial institution

The upper your banks APY, the extra money they pay you to financial institution with them. So don’t accept a mean APY of 0.08%. CIT’s Financial savings Builder account presents hovering rates of interest which are at the very least 10X the nationwide common. Take a look at CIT’s reside banner beneath for the present Financial savings Builder APY.

Take a look at the CIT Financial savings Builder account right here, see how straightforward it’s to open an account, and see how the rates of interest will profit you.

Begin incomes free cash while you open a CIT Financial savings Builder account at present.

Get Amazon Prime Free for a 12 months

For a restricted time, while you open a CIT Financial institution Cash Market Account, you’ll obtain a free yr of Prime (even when you have already got a Prime membership)!

Right here’s tips on how to get your free yr of Prime: Open a CIT Financial institution Cash Market Account and enter the promotion code AMZN22. Preserve a stability of at the very least $15,000 for 60 days. On the finish of the 60 days, you’ll obtain a Prime code to make use of.

CIT Financial institution makes it straightforward to open an account. Your cash is insured by the FDIC, and there aren’t any month-to-month service charges. Open a Cash Market Account at present and declare your free yr of Amazon Prime.

Associated: Finest Free Checking Accounts for 2020

5. Money-Again on Every little thing

OK, we’re on our fifth and ultimate hack. By now, you incorporating all of those techniques and methods could have a multiplying impact that may actually prevent hundreds of {dollars} a yr, if you’re simply common. Now, we’re going to kick it up a notch by recommending you employ bank cards to your benefit, whether or not they’re cash-back playing cards or journey rewards playing cards.

Bank cards are a software that will help you attain your monetary objectives. Use them to your benefit. We’re not recommending piling up new debt and shopping for belongings you can’t afford. Nonetheless, when you purchase stuff on-line, use a cash-back card, get Rakuten cash-back rewards and let Dosh work its magic.

You won’t be ready to do that, however a father used to place his son’s faculty tuition on a Uncover cash-back card. If tuition, room and board got here as much as $25,000, then he made a cool $500 with a 2% money again reward.

Money Again Playing cards

With money again playing cards, you earn factors for each greenback you spend. Typically the incentives are 1-2%, however it may go increased, particularly throughout an introductory provide.

Some latest presents over on Credit score Land included:

- 5% money again rotating classes

- 1.5% again on each buy + a one-time bonus of $150

- 2% money again on every thing.

Journey Playing cards

With money again bank cards we converse of factors, however with journey bank cards we converse of miles. Whether or not factors or miles, we’re referring to the identical factor: Rewards. When taking a look at journey playing cards, take into accout 100 miles equates to about $1 in journey advantages.

You may be considering, why would I get a journey rewards card, I don’t fly a lot. These rewards playing cards usually are not frequent flyer packages. They construct up money rewards that can be utilized for journey. Some playing cards pays you money again. Some playing cards gives you 2X miles while you use your card at grocery shops, eating places or fuel stations.

Having stated that, some journey playing cards are linked with airways that gives you sure privileges, like getting your complete household’s first checked bag without spending a dime. That’s a $200 spherical journey financial savings for a household of 4. Hold that $200 in your financial savings account!

When taking a look at a journey bank card, there are a whole lot of choices. Search for one with a excessive sign-up bonus. You’ll get essentially the most miles via the sign-up course of.

earn a living together with your bank card

If you wish to earn a living together with your bank card, and construct your financial savings even quicker, you may by no means go into bank card debt.

The important thing right here is to repay your stability each month. You don’t want to be ready the place you’re paying 15-20% curiosity on balances simply to chase 2% in money again. That is mindless, and it goes in opposition to all we educate.

Additionally See: 9 Dave Ramsey Ideas You Must Destroy Debt

6. Spend Cash Strategically with a Funds

For some, budgeting is a four-letter phrase. That’s a disgrace. We talked about above how funds contributed to a whole lot of stress, worrying, and lack of sleep. Budgeting may help erase a whole lot of that.

A price range is solely a plan that may transfer you towards monetary freedom. Listing all bills and evaluate them to how a lot cash you earn. Then craft a plan to spend lower than you earn.

Decide to your plan. It’s your roadmap to a greater future. Each month ought to get simpler for you as you determine the place you may lower spending. On the identical time, you’ll profit from all the hacks you carried out.

To date on this publish, we now have proven you methods to chop bills, methods to economize via money again apps, and tips on how to earn a better rate of interest in your financial savings. However, now, we’re going to concentrate on altering the way you deal with cash to save lots of extra, and reside life with a peace that comes via monetary safety. All of it begins with a choice.

Free Workshop – Be part of our free Simplify Cash Workshop

The *solely* means to economize is to spend lower than you earn. Meaning you want to lower your bills or improve your earnings.

We wish to show you how to do each.

Be part of our FREE Simplify Cash Workshop to study the basics of rising wealth. As a result of when you may spend lower than you earn, your cash has no selection however to develop. You’ll construct your financial savings and pay down debt.

What’s extra? We’ve obtained a bunch of free money-hacks to share with you:

- Hacks to decrease your month-to-month payments

- Hacks to spend much less on debt

- Hacks to begin investing

- Hacks to extend your earnings by $20/month (with no further effort)

This workshop has every thing you want to accomplish the cardinal rule of non-public finance: preserve your earnings over your bills.

Be part of our free 5-day Simplify Cash Workshop, and begin rising your wealth at present.

Save Extra Cash! Learn these subsequent…

Save Cash At Your Favourite Shops:

A budgeting fanatic and a frugal residing lover! We wish to share our budgeting strategies due to how a lot they’ve improved each facet of our life! We educate the final word solution to price range so it can save you tons of cash, eradicate debt quick, and obtain guilt-free spending!