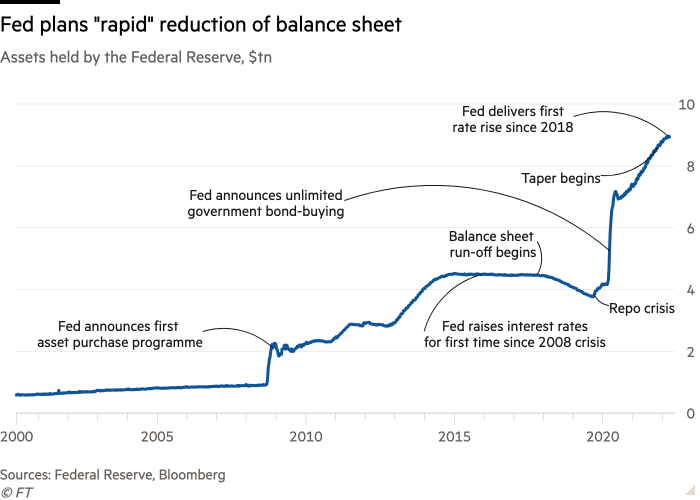

The Federal Reserve is about to start out shedding $95bn of belongings a month from its swollen $9tn steadiness sheet because it steps up efforts to curb hovering inflation within the US.

An account of the Federal Open Market Committee’s final assembly in March confirmed officers finalising a plan to scale back the central financial institution’s presence in US authorities bond markets, a course of that may start as early as subsequent month.

The Fed’s footprint in debt markets expanded considerably in the course of the pandemic because it hoovered up trillions of {dollars} of Treasuries and company mortgage-backed securities in an try and stave off an financial cataclysm.

However confronted with persistently excessive inflation, the Fed is now making an attempt to tighten financial coverage, and decreasing the dimensions of its steadiness sheet is the principle lever it may well pull to chill down the US financial system after elevating rates of interest.

Based on the minutes of the March assembly, officers broadly help the Fed rising the tempo at which it pares again its asset holdings over the approaching months through a course of often known as “run-off”, whereby the central financial institution stops reinvesting proceeds from maturing securities.

Members of the FOMC broadly agreed on month-to-month caps of about $60bn for Treasuries and $35bn for company MBS, phased in over a interval of three months or “modestly longer if market situations warrant”. That quantities to asset reductions of simply lower than $1tn a yr.

“The Fed has clearly recognised at this level that they’re behind the curve,” stated Eric Winograd, an economist at AllianceBernstein.

Winograd added: “Once you’re behind the curve it’s a must to hurry to catch up. They’re now hurrying . . . They had been rising the dimensions of the steadiness sheet 4 weeks in the past. And now 4 weeks from now they’ll be decreasing it.”

In the meantime, the minutes confirmed officers are open to extra aggressive charge rises this yr to battle rising costs following the Fed’s choice to boost the federal funds charge by 1 / 4 of a proportion level final month — the primary improve since 2018.

Many contributors stated a number of half-point rate of interest will increase at forthcoming conferences could possibly be applicable if inflation stays excessive or intensified.

If the Fed adopted by with two such changes this yr, as markets at the moment anticipate, the federal funds charge would attain a “impartial” stage that neither accelerates or slows down development by the top of the yr. Officers estimate that charge to be between 2.3 per cent and a couple of.5 per cent.

The Fed plans to prime up its asset reductions by shedding holdings of shorter-dated Treasury payments in months when the quantity of longer-dated bonds maturing is under the brand new caps.

Officers are also contemplating outright gross sales of the Fed’s company MBS holdings as soon as the steadiness sheet shrinkage is “nicely below approach”. The Fed has beforehand indicated that it will desire to have solely Treasuries in its portfolio.

Jim Caron, a portfolio supervisor at Morgan Stanley, stated the truth that outright gross sales of company MBS gross sales are being thought of “speaks volumes” in regards to the scale of financial tightening it have to implement in an effort to curtail inflation.

The minutes present central bankers wish to shrink the steadiness sheet shortly, and way more swiftly than the earlier try and shed belongings in 2017 after the Fed’s holdings had ballooned because of bond-buying within the wake of the worldwide monetary disaster that began in 2008.

Again then, the Fed capped the month-to-month discount in its steadiness sheet at $50bn and took a yr to succeed in that tempo.

Lael Brainard, a governor who’s awaiting Senate affirmation to change into the Fed’s subsequent vice-chair, on Tuesday stated a “speedy” discount within the dimension of the steadiness sheet was justified given the diploma to which inflation is overshooting the central financial institution’s 2 per cent goal and the energy of the labour market.

Jay Powell, Fed chair, has instructed that the anticipated tempo of steadiness sheet discount this yr is roughly equal to a one quarter-point rate of interest improve.

Within the weeks because the assembly, at which a majority of officers signalled the coverage charge ought to rise to 1.9 per cent by the top of 2022, policymakers have publicly backed an much more hawkish stance.

Mary Daly, president of the San Francisco Fed, instructed the Monetary Instances on Friday that the case for a half-point charge improve on the Might assembly had grown, echoing quite a few her colleagues who’ve in latest weeks signalled help for a quicker and extra forceful tightening of financial coverage.