In the case of fairness funding, many people live in DREAM than understanding REALITY. Just lately I got here throughout a tweet the place it was assumed the previous Nifty 50 efficiency of 13% to 14% returns. Based mostly on that, the rosy image of compounding was created and showcased how simple it’s to create wealth by simply assuming previous returns of Nifty. It’s nothing however a half-baked fact.

Mainly, the tweet was as beneath.

In case you are investing 30k monthly, the primary 1 Cr will take about 12 years (assuming 13-14% CAGR consistent with nifty 50 historic returns). The 2nd crore will take solely 4 years The third crore: solely 2 yrs

And…. That’s compounding! Cash makes cash.

Amazingly it’s TRUE on paper. Nonetheless, the journey of those 12 years (the place you accumulate the primary one crore) and in a while the remaining 6 years journey (in whole 18 years journey) isn’t so easy as these FINANCIAL INDUSTRY EXPERTS educate us.

In my earlier posts additionally, I’ve showcased that to reap the advantages of compounding, what are the components we will need to have – “Energy Of Compound Curiosity – NOT the eighth Marvel of the world!“.

On this submit additionally, allow us to run the check primarily based on NIfty 50 TRI information of the previous 19 years (from 2003) and allow us to see how this DREAM Vs REALITY really seems like.

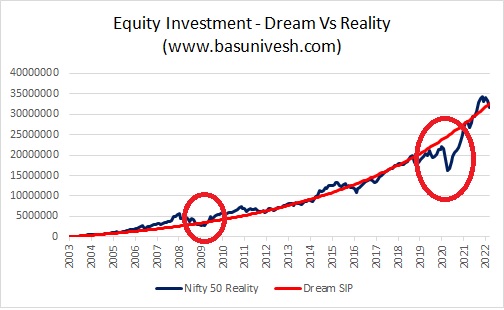

Fairness Funding – Dream Vs Actuality

I’ve taken the Nifty 50 TRI information from Jan 2003 to March 2022 (The Nifty 50 TRI information is obtainable from 2003). This can give us round 4,617 each day values of the Nifty 50 TRI Index. I’ve chosen the tenth because the SIP date for each month (simply randomly).

Similar manner, I’ve calculated the SIP like the way it was showcased in that Tweet of investing month-to-month Rs.30,000 for the following 19 years and assuming the returns of Nifty 50 TRI of 13.4%.

After we graph the DREAM of assuming 13.4% returns on funding versus the journey of the Nifty 50 TRI Index for 19 years, it seems just like the beneath.

Discover the graph cautiously particularly across the 2008-2009 downfall and through the latest crash of 2020. Truly, the drawdown throughout 2008-2009 was nearly round 50% in worth. It’s not seen within the graph as the quantity was much less in comparison with what it was in 2020.

The dream SIP journey as ordinary seems easy. Nonetheless, the true journey of SIP in Nifty 50 TRI was stuffed with numerous ups and downs. As I informed you, through the 2008-2009 market crash, your invested worth was down by nearly 50%.

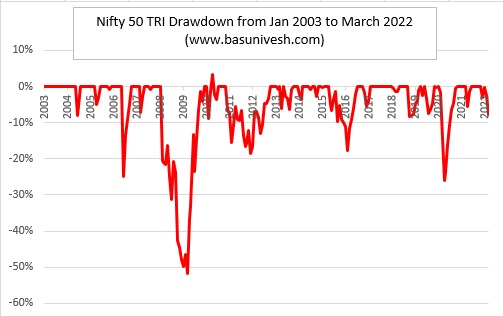

This may be calculated from the drawdown of the portfolio. The drawdown is nothing however the % of fall from its earlier peak. The drawdown chart of the funding for the previous 19 years in Nifty 50 TRI seems like beneath.

You seen that through the interval of 2008-2009, the utmost drawdown within the portfolio was nearly round 51%. In the identical manner, you can too expertise it through the 2020 crash too however not in an enormous manner.

Allow us to additionally attempt to perceive this volatility by the rolling return of Nifty 50 TRI over the previous 19 years. This can really provide the precise sense of volatility.

# Nifty 50 TRI 3 Yrs Rolling Returns

The utmost return for such 3 years’ rolling returns was 61% and on the identical time, the minimal return was -4.7%. It means throughout this 19 years interval, if somebody is investing for 3 years interval, then one can anticipate such returns. It’s primarily based on the out there 3,879 3 years of interval information.

# Nifty 50 TRI 5 Yrs Rolling Returns

For five Yrs rolling returns, the utmost return was 41% and the minimal was -1%. Therefore, if suppose somebody investing in Nifty 50 and holding for five years, then these two excessive outcomes occurred previously. That is primarily based on the out there 3,376 values of 5 years’ rolling returns.

# Nifty 50 TRI 10 Yrs Rolling Returns

For 10 years of rolling returns, the utmost return was 23% and the minimal was 6%.

# Nifty 50 TRI 15 Yrs Rolling Returns

Allow us to now think about an extended time horizon of 15 years, you seen that the utmost returns one may generate was 19% and the minimal was 10%.

It’s evident from all of the above factors that Nifty generated round 13% to 14% returns since its inception. Nonetheless, it’s primarily based on point-to-point calculation. However the journey was not so easy. It was stuffed with numerous ups and downs, which many of those guys ignore and showcase solely the rosy image of fairness funding.

Targetting or anticipating 10% to 13% or 14% is okay. Nonetheless, the purpose right here to notice is how was the journey and the way unstable was this journey. Therefore, fairness investing is okay and the idea of compounding can be tremendous. Nonetheless, for those who fail to know the trail and what are the eligibility qualities of an investor to maintain such volatility, then it’s possible you’ll face failure even after investing for the long run. Therefore, be real looking along with your expectation and in addition give significance to a path like how you might be giving significance to the purpose. By no means be within the lure of such a rosy image defined to you by the monetary business.