This text is an on-site model of our The Week Forward publication. Enroll right here to get the publication despatched straight to your inbox each Sunday

Howdy and welcome to the working week,

Did you miss me? Thanks to those that emailed — to [email protected] — whereas I used to be away. And for many who didn’t, you might be welcome to drop me a line now about occasions you suppose ought to (or shouldn’t) be talked about on this publication.

Depressingly, the Ukraine battle is a certainty for information occasions this week however exercise might be largely off diary — aside from occasions such because the UK reopening its embassy in Kyiv — for the following seven days. Considerably satirically there’s a lengthy listing of different conflict anniversaries this week — from Monday’s Anzac Day to Saturday’s commemoration in Vietnam of Liberation Day. A reminder that peace has been an unobtainable dream for this world in trendy instances.

On the similar time, we’re in a type of minor vacation season. Easter, orthodox or in any other case, has been and gone and this coming Sunday heralds the assorted Could Day celebrations world wide.

In the intervening time this article was despatched, the results of the ultimate spherical of the French presidential election was imminent. Subsequent comes the evaluation — a purpose to maintain linked to the FT’s protection.

Earlier than getting on to the financial and company information, here’s a plug for an FT occasion this week. The Future Cities Americas discussion board, operating from Tuesday to Thursday, will deliver collectively authorities leaders, corporates, innovators, lecturers, traders and monetary providers specialists to determine a standard imaginative and prescient for the sustainable, equitable, and secure cities of tomorrow. And as a publication subscriber, you’ll be able to register free right here.

Financial knowledge

It’s a reasonably full week for financial information with inflation figures for France, Germany and the eurozone international locations in addition to first-quarter GDP estimates for the eurozone, the US, Korea, France, Germany Italy and Spain plus an rate of interest choice by the Financial institution of Japan.

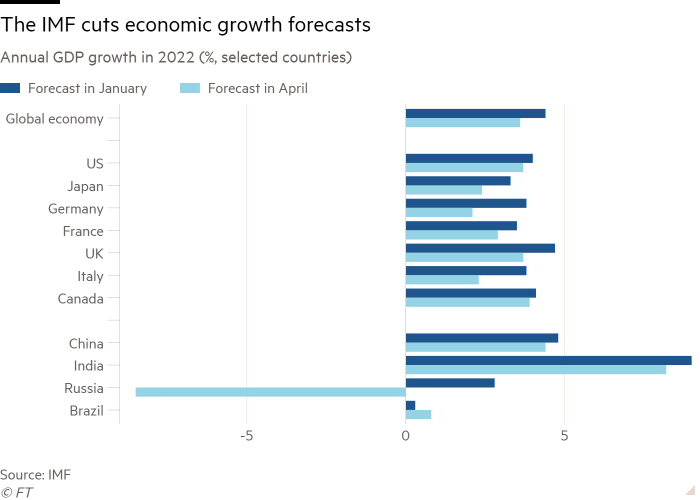

The battle in Ukraine is having a direct and long run influence on the worldwide financial system, because the IMF highlighted final week when it reduce progress forecasts for quite a few international locations.

The brand new world (dis)order was described by Pierre-Olivier Gourinchas, IMF chief economist, in an interview with the Monetary Occasions. “If we develop into a world of many various blocs, we must undo lots of the built-in economies that we’ve constructed and provide chains that we’ve constructed . . . and construct one thing else that’s extra slim [and] smaller in scope,” he stated.

“There might be adjustment prices [and] there might be effectivity losses and that would result in a rise in unit prices as a result of issues are usually not performed as effectively as earlier than.”

Firms

It is going to be per week for the geeks by way of company earnings this week. Huge Tech has had a great pandemic. The query now’s whether or not Meta, Alphabet, Amazon.com, Microsoft or Spotify can keep their robust progress charges. After final week’s Netflix shock drop in subscribers, traders are little doubt nervous, though as has been identified there’s a distinction between an organization purely targeted on streaming TV and movie reveals and different tech companies.

Golden baby Apple could now fancy itself as a Hollywood participant after taking high prize on the Oscars, however its traders are worrying about its potential to ship new tech package given the wave of lockdowns at a number of of its Chinese language manufacturing hubs. That subsequent iPhone mannequin gained’t make itself, you recognize. Analysts at Morgan Stanley consider Wall Avenue’s consensus forecasts for the June quarter of $86.7bn (an increase of 6 per cent 12 months on 12 months) “appears excessive” given chief govt Tim Cook dinner’s typical warning in relation to steerage.

Key financial and firm stories

Here’s a extra full listing of what to anticipate by way of firm stories and financial knowledge this week.

Monday

-

Germany, Ifo enterprise confidence survey

-

UK, Financial institution of England’s asset buy facility quarterly report, Rightmove April home value survey plus CBI quarterly industrial developments report

-

Outcomes: Activision Blizzard Q1, Deutsche Börse Q1, Hyundai Motor Firm Q1, Philips Electronics Q1, Roche Q1, Südzucker H1, Vivendi Q1

Tuesday

-

South Korea Q1 GDP knowledge

-

Taylor Wimpey buying and selling replace and AGM

-

UK, March tax receipts knowledge displaying the state of the general public funds

-

US, shopper confidence figures and March sturdy items orders

-

Outcomes: 3M Q1, Alphabet Q1, Related British Meals H1, GE Q1, Normal Motors Q1, HSBC Q1, Iveco Q1, Kuehne & Nagel Q1, Microsoft Q3, Nomura FY, Novartis Q1, PepsiCo Q1, Texas Devices Q1, UBS Q1, United Parcel Service Q1

Wednesday

-

Fresnillo Q1 manufacturing report

-

France, shopper confidence figures

-

Germany, Gfk shopper confidence figures

-

UK, Freedom of Info statistics

-

US, Q1 housing vacancies and residential possession knowledge

-

Outcomes: Boeing Q1, Credit score Suisse Q1, Daiwa Securities Group This autumn, Deutsche Financial institution Q1, GlaxoSmithKline Q1, Lloyds Banking Group Q1 interim administration assertion, Mattel Q1, Mercedes-Benz Q1, Meta Q1, Puma Q1, Spotify Q1, STMicroelectronics Q1

Thursday

-

EU, financial and enterprise sentiment indicators plus the European Central Financial institution’s month-to-month financial bulletin

-

Supply Hero Q1 buying and selling replace

-

Evraz Q1 buying and selling replace

-

Germany, April shopper value index (CPI) inflation knowledge

-

Glencore Q1 manufacturing report and AGM

-

Japan, Financial institution of Japan rate of interest choice and outlook report for financial exercise and costs, plus retail gross sales figures

-

Schroders Q1 buying and selling replace

-

Smith & Nephew Q1 buying and selling replace

-

Spain, April inflation knowledge and unemployment figures

-

Sweden, central financial institution Riksbank holds its financial coverage assembly in Stockholm

-

Unilever Q1 buying and selling assertion

-

UK, This autumn insolvency statistics plus NHS workforce knowledge and inflation dangers for public providers in England

-

US, Q1 GDP estimate plus Q1 shopper spending figures

-

Outcomes: Amazon.com Q1, Apple Q2, Barclays Q1, Carlsberg Group Q1 buying and selling assertion, Caterpillar Q1, Comcast Q1, Eli Lilly and Co Q1, Hershey Q1, Intel Q1, McDonald’s Q1, Merck & Co Q1, Nokia Q1, Northrop Grumman Q1, Sainsbury’s H1, Samsung Electronics Q1, Swedbank Q1, Complete Q1, VeriSign Q1

Friday

-

Canada, February GDP figures

-

EU, flash Q1 GDP estimate plus euro space inflation figures

-

France, preliminary Q1 GDP estimate and April CPI knowledge

-

Germany, Q1 GDP figures

-

Italy, GDP figures

-

Mexico, Q1 GDP knowledge

-

Rémy Cointreau FY gross sales figures

-

Smurfit Kappa Q1 buying and selling replace and AGM

-

Spain, Q1 GDP figures

-

Travis Perkins Q1 buying and selling replace

-

UK, British Retail Consortium month-to-month financial briefing, authorities deficit and debt figures, Workplace for Nationwide Statistics knowledge on how modifications within the workforce have affected earnings progress through the Covid-19 pandemic, illness absence knowledge, Nationwide’s April home value index plus quarterly betting and gaming statistics

-

Outcomes: AstraZeneca Q1, BASF Q1, Chevron Q1, Colgate-Palmolive Q1, Danske Financial institution Q1, Electrolux Q1, Eni Q1, ExxonMobil Q1, Honeywell Q1, NatWest Q1

Saturday

World occasions

Lastly, here’s a rundown of different occasions and milestones this week.

Monday

-

Australia, New Zealand and Turkey: the 107th anniversary of the beginning of the primary world conflict Gallipoli marketing campaign might be commemorated with Anzac Day

-

China, the UN Biodiversity Convention (COP15) opens in Kunming

-

Italy, Liberation Day commemorating the top of Nazi occupation within the second world conflict

-

North Korea, ninetieth anniversary of the creation of the Korean Folks’s Revolutionary Military

-

UK, the final financial institution department on the Isles of Scilly — run by Lloyds Financial institution on St Mary’s — because of shut its doorways right this moment

Tuesday

-

Ukraine, anniversary of the 1986 Chernobyl nuclear energy plant catastrophe

-

UK, the second time period of the authorized 12 months in England and Wales, the Easter time period, begins and can run till Could 27

-

US, the twenty sixth Webby awards — ‘the Oscars of the web’ — are introduced

-

World Mental Property Day

Wednesday

-

Israel, Holocaust Martyrs and Heroes Remembrance Day marked in Jerusalem

-

The Netherlands, Koningsdag nationwide vacation marking the delivery of King Willem-Alexander

-

Sierra Leone, Nationwide Day

-

South Africa, Freedom Day marking the date when Nelson Mandela was elected president in 1994

Thursday

Friday

-

UK, Three-time Wimbledon champion Boris Becker faces sentencing at Southwark Crown Courtroom in London after being discovered responsible of 4 costs beneath the Insolvency Act regarding his 2017 chapter

-

Portugal, parliament to vote on the working majority Socialists finances draft

Saturday

-

Partial photo voltaic eclipse over South America, Antarctica, Pacific and Atlantic Oceans

-

US, The White Home Correspondents’ Affiliation holds its annual dinner on the Washington DC Hilton. Sitting presidents normally attend

-

Vietnam, Liberation Day celebrating the anniversary of the autumn of Saigon — now Ho Chi Minh Metropolis — to the Communist Democratic Republic of Vietnam

Sunday

-

China, begin of the five-day Could Day vacation

-

Could Day celebrated in varied international locations

-

US, date to which president Joe Biden deferred pupil mortgage funds final December

Really useful newsletters for you

Commerce Secrets and techniques — A must-read on the altering face of worldwide commerce and globalisation. Enroll right here

Disrupted Occasions — Covid’s influence on the worldwide financial system, markets and enterprise. Enroll right here