Irrespective of how precarious their monetary scenario, nearly each consumer I meet thinks chapter will destroy their credit score rating.

Not solely destroy it, however harm it all the time, precluding regular life after chapter.

Some resolve to stagger alongside, burdened with their debt and the concern of escaping debt.

So, my encounter with a monetary columnist was on level.

Liz Weston, L.A. Instances monetary author, led a room stuffed with chapter attorneys via the influence of assorted life occasions on one’s credit score rating.

She recounted how, after assembly some debtors as she labored on tales, she not noticed debtors as deadbeats.

She noticed the challenges of their lives and the soundness of electing chapter. Her candor concerning the change in her world view was refreshing.

Having written a e-book on credit score scoring, she naturally was caught up within the interface with chapter.

However as one who’s annoyed by the fixation of these drowning in debt on their credit score rating, I needed to face up and shout:

Break your credit score rating, not your life!

The monetary media sounds a drum beat that one’s life and value is wrapped up in that credit score rating. All of the whereas, that rating is one thing we don’t absolutely perceive and is predicated on credit score experiences that are notoriously inaccurate.

Life will finish, we’re advised, if our credit score rating declines.

Poppycock!

That concern retains American shoppers struggling to pay debt that they will by no means repay, on this life or the subsequent. So as to protect their credit score rating, they seem resigned to a lifetime of minimal funds slightly than a contemporary begin in chapter

As Liz identified, the credit score rating is dynamic: it’s continuously altering, and heals over time.

My name is to repair your stability sheet.

- Do away with dischargeable money owed.

- Save for retirement.

- Reside beneath your means.

- Have some reserves.

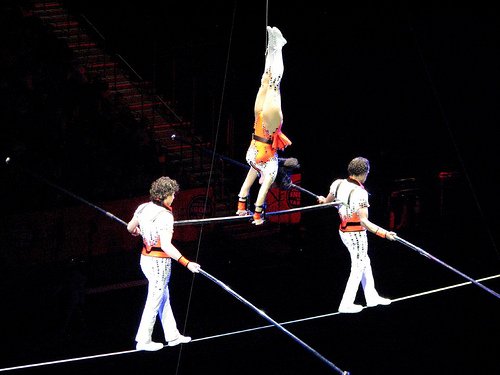

Don’t stroll the monetary tightrope.

Picture courtesy of terwilliger911,? pursuant to a Artistic Commons license.