Lambert right here: Arduous to be a twenty first Century “arsenal of democracy” once you’ve outsourced your manufacturing base to China. However right here we’re.

By Maria Bas, Economist, CEPII, and Ana Fernandes, Lead Economist, Commerce and Worldwide Integration Unit, Improvement Analysis Group, World Financial institution. Initially printed at VoxEU.

The conflict in Ukraine has dramatically revealed the vulnerabilities of relying closely on single overseas suppliers, following on from the COVID shock’s disruption of worldwide worth chains. This column presents proof confirming the pricey export shock for merchandise with greater reliance on overseas inputs, and on China as the principle enter provider, through the pandemic. Specifically, the difficulties in producing remotely highlighted the vulnerability for merchandise with a decrease diploma of complexity that depend on unskilled labour. Future resilience requires sensible diversification and exploitation of working-from-home manufacturing.

Between January and June 2020, the amount of worldwide commerce retracted by 13%, with a pointy rebound from then onwards because the COVID-19 state of affairs briefly improved (World Financial institution 2020). International shortages in face masks and medical tools led many nations to ban their export (Evenett 2020), and a adverse demand shock linked to heightened uncertainty account for a few of the commerce lower. In a brand new paper (Bas et al. 2022), we offer proof pointing to 2 most important components behind disruptions to commerce brought on by the COVID-19 shock: (i) the breakdown of manufacturing throughout the globe inflicting vulnerabilities in merchandise that required inputs produced in particular nations; and (ii) restrictions to in-person manufacturing as a result of pandemic creating vulnerability for merchandise which are tougher to provide remotely.

First, disruption to manufacturing as a result of COVID-19 shock throughout the globe affected worth chains. The sudden drop within the provide of merchandise from China led to a debate about whether or not the elevated exploitation of worldwide comparative benefit, which had turned China into the world’s manufacturing powerhouse within the decade previous to COVID-19, had produced a harmful overseas dependence on international manufacturing networks. China’s not too long ago imposed lockdowns within the manufacturing hubs of Shenzhen and Dongguan are a reminder of the necessity to improve the resilience of provide chains. The Russia-Ukraine conflict has additional illustrated that the resilience of overseas provide chains is a precedence past the COVID-19 shock in want of great consideration going ahead.

Second, the sudden onset of the COVID-19 shock in early 2020 resulted in substantial disruptions to financial actions as a big share of the worldwide inhabitants was confined to dwelling and a myriad of restrictions to cut back the unfold of the virus have been put in place (Baldwin 2020, Bénassy-Quéré et al. 2020). Whereas high-skilled staff shifted to distant work and even skilled productiveness positive factors (Barrero et al. 2021), much less advanced manufacturing relying totally on unskilled staff was compromised.

What Is the Financial Magnitude of the Impact?

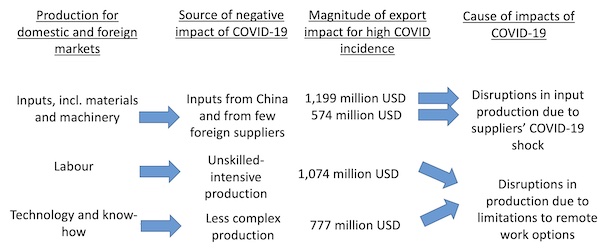

Our estimates, primarily based on detailed product import knowledge for the US, Japan and 28 EU nations in 2020, level to the substantial financial magnitude of the disruptions throughout three mechanisms brought on by disruptions in enter manufacturing and to in-person manufacturing. These are described in Determine 1.

Determine 1 The channels explaining the adverse impact of COVID-19 on exports

Nations with greater COVID-19 incidence (captured by COVID deaths per capita) expertise a 1.5 percentage-point bigger decline in exports of extra unskilled intensive merchandise, comparable to a lower of US$1,074 million in median exports.1 The same improve in COVID-19 incidence decreases exports of merchandise with a better reliance on inputs for which China is a dominant provider by 1.69 proportion factors, and exports of merchandise with greater reliance on overseas inputs by 0.81 proportion factors, comparable to decreases in median exports of $1,199 million and $574 million, respectively. Lastly, an analogous improve in COVID-19 incidence results in a lower in exports of merchandise with decrease complexity by 1.09 proportion factors which corresponds to a $777 million lower in median exports.

Classes for Future Crises

The place there’s sturdy reliance on a small set of suppliers, efforts geared toward attaining sensible diversification have to be a key precedence for coverage and trade. This requires having international manufacturing and provide preparations that supply a portfolio of choices away from focus, significantly the place there’s very sturdy reliance on a small set of overseas suppliers. This doesn’t in any respect imply decoupling from international worth chains and the reliance on imported inputs, as a result of that might not repay and would come at a excessive value (Baldwin and Evenett 2020, Grossman et al. 2021, OECD 2022a). Quite the opposite, participation in international worth chains really diminished slightly than elevated vulnerability to home shocks through the pandemic as overseas sourcing was a useful diversification via commerce when home manufacturing is disrupted (Eppinger et al. 2021, Espitia et al. 2020). International worth chains have been pivotal for nations to get items wanted to vaccinate, shield and check through the COVID-19 pandemic (OECD 2022b).

As to resilience towards future pandemics or conflicts that will restrain mobility and have an effect on in-person manufacturing, additional deployment of digital instruments will help to successfully substitute in-person collaboration in manufacturing and likewise contribute to effectivity (Barrero et al. 2021). The automation of manufacturing also can scale back manufacturing vulnerabilities. Nonetheless, this poses the chance of potential adverse impacts on unskilled employment which might solely be addressed via investments in employee upskilling and different fashions for income sharing within the financial system (Guellec and Paunov 2017, Autor et al. 2020).

Authors’ observe: The findings, interpretations, and conclusions expressed on this column are solely these of the authors. They don’t essentially characterize the views of the OECD, the Worldwide Financial institution of Reconstruction and Improvement/World Financial institution and its affiliated organisations, or these of the Government Administrators of the World Financial institution or the nations they characterize. All errors are the authors’ duty.