Closed societies can at all times change into wealthier by buying and selling. Maybe essentially the most dramatic illustration of development by commerce was realized by Japan after the Meiji restoration in 1868, ending the Tokugawa Shogunate based in 1603. For over 250 years the Shogunate enforced a coverage of financial isolation. Japan’s subsequent openness to worldwide commerce enabled it to get better from World Struggle Two and change into one of many world’s most prosperous nations on earth in lower than a era.

Each nation can profit by decreasing import tariffs to zero, making worldwide commerce even cheaper, however many have opted for tariffs and different commerce restrictions to guard home industries and employment. World commerce grew dramatically over the twentieth century, particularly because the finish of World Struggle Two. This is able to be true anyway, as a result of world GDP grew over the identical interval, however world commerce additionally elevated dramatically as a share of world GDP.

On the finish of World Struggle Two, recognizing the detrimental affect of excessive tariffs enacted throughout the Despair, the victorious allies met at Bretton Woods, New Hampshire and negotiated the three Bretton Woods organizations. These have been the Worldwide Financial Fund (IMF), the Worldwide Financial institution for Reconstruction and Improvement (IBRD), higher often known as the World Financial institution, and a proposed Worldwide Commerce Group (ITO). The ITO was by no means organized as a result of the US Senate wouldn’t ratify the enabling treaty, although the US did assist and take part within the Normal Settlement on Commerce and Tariffs (GATT).

By casual settlement, the World Financial institution president has virtually at all times been an American, and the IMF managing director have to be from one other nation, although each organizations are headquartered in Washington. The World Financial institution was initially charged with administering a revolving mortgage fund to facilitate the reconstruction of war-torn Europe and Asia. As soon as that job was completed, the World Financial institution turned its consideration to the creating world, although in apply this was supplemented by Marshall Plan loans straight from the US.

The IMF was initially charged with administering a set alternate fee system the place every nationwide forex was convertible to US {dollars}, and the greenback was mounted to gold at $35 per ounce—a big drop from the pre-Despair worth of $20. This mounted alternate fee system collapsed between 1971 and 1973, and since intergovernmental bureaucracies naturally search immortality, the IMF reinvented itself as a improvement lender competing with the World Financial institution, in addition to with a variety of regional improvement banks applied through the years, such because the Inter-American Improvement Financial institution (IDB) based in 1959 in Washington, the Asian Improvement Financial institution (ABD) based in Manila in 1966, and the European Financial institution for Reconstruction and Improvement (EBRD) in London, organized in 1991 within the wake of the collapse of the Soviet Union.

The ITO was by no means organized as a result of US participation was needed. This was withheld as a result of the Senate declined to ratify the mandatory treaty. However, the US participated within the Normal Settlement on Commerce and Tariffs (GATT), which took impact in 1948. GATT signatories dedicated to steady tariff discount. By the eighties, tariffs had fallen to negligible ranges on many items. GATT was changed by the World Commerce Group (WTO) in 1995, although the 1947 GATT treaty stays one of many WTO’s enabling paperwork. The expansion of world commerce has helped improve nationwide GDPs and contributed to every nation’s productiveness, because it’s cheaper for buying and selling nations to import all the things that may value them extra to supply at dwelling. It additionally makes a wider vary of products and companies obtainable and allows buying and selling nations to concentrate on these merchandise they’ve a comparative benefit in producing.

Along with its basic dedication to steady tariff discount, the WTO offers a mechanism for adjudicating commerce disputes amongst nations. Nevertheless, when the WTO finds benefit in a single nation’s criticism, essentially the most it may possibly do is allow the complainant to impose a retaliatory tariff. This sort of enforcement mechanism tends to favor massive nations over small ones, for whom a retaliatory tariff could be devastating. International locations have additionally negotiated tariff reductions by commerce agreements just like the North American Free Commerce Settlement (NAFTA), the United States-Mexico-Canada Settlement (USMCA), the European Union (EU), and the Trans-Pacific Partnership (TPP), although generally these highly-touted free commerce preparations present entire rafts of exemptions to favor privileged companies and industries. In some circumstances they successfully circumvent the WTO’s low-tariff laws.

Historically, worldwide commerce was understood largely when it comes to agricultural specialization. Labor and capital have been taken as a right, nevertheless it was acknowledged that nations with extra temperate climates and good soil had a bonus in rising just about all the things. For instance, France has an absolute benefit over England in rising each wheat and grapes, however this absolute benefit is stronger in grapes than in wheat. That made it advantageous for the French to import wheat from England, which they paid for by exporting wine.

Having the English develop wheat for export to France freed up extra land in France for grape cultivation, leading to each nations’ having the ability to devour extra bread and extra wine than both might produce individually with out commerce. Although France has an absolute benefit in producing each merchandise, the path of commerce follows comparative benefit. France has a comparative benefit in producing wine, each in contrast with its capability to develop wheat, in addition to in contrast with England’s capability to supply wine. England has an absolute disbenefit in comparison with France in rising each crops, however nonetheless enjoys a comparative benefit in wheat, each in comparison with France and in comparison with rising grapes in England.

As Adam Smith noticed, worldwide commerce expands the extent of the market, enabling extra individuals to take part, and offering extra alternatives for specialization and positive factors from commerce. At the moment it’s fairly widespread for Individuals to purchase manufactured items that have been made as far-off as China. Another tendencies which have occurred over the identical interval are a rise in manufactured items being traded internationally, in contrast with agricultural output, regardless that the entire bodily quantity of agricultural items being traded is far larger at this time than previously, and the expansion of commerce in companies.

All through a lot of the 1800s, America exported agricultural crops and uncooked supplies, and imported manufactured items from extra industrialized Europe. After World Struggle Two, the US was a web exporter till about 1970, however since then we’ve run a persistent commerce deficit. After we import items from China, we pay in US {dollars}. There may be nonetheless some demand for foreigners to carry {dollars} as a consequence of its function as a reserve forex, an artifact of the 1945-1973 Bretton Woods system administered by the IMF. Maybe extra essential is the truth that traditionally, at any time when US inflation will get uncontrolled, it has typically been worse elsewhere. Ultimately the {dollars} have to return again to the US to purchase US-produced items or another dollar-denominated belongings. The federal government has performed a serious function in exploding the US commerce deficit as a result of it habitually spends past its means, beneath each events.

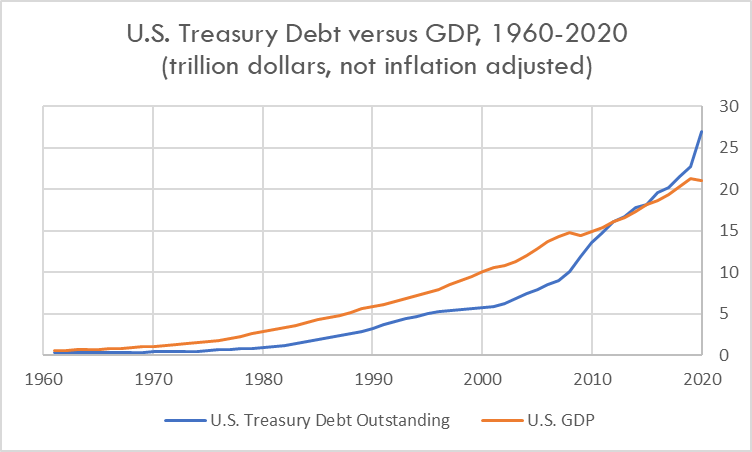

Determine 1

Treasury debt created to finance the shortfall between tax revenues and authorities spending more and more retains the {dollars} we spend on imported merchandise coming again to finance our exports. As a substitute of exporting manufactured output that employs Individuals, we’re successfully exporting US Treasury bonds. For the final quarter of the 1900s, Japanese savers have been the most important holders of US Treasury debt. From their perspective, it was safer and higher-returning than some other funding. This grew to become much less true because the Japanese authorities adopted in our footsteps and ran up vital debt of its personal beginning about 1990, and the US authorities lowered rates of interest to stimulate the economic system in response to the 2007-2009 recession. Within the 2000s Chinese language state-owned enterprises grew to become the most important holder of US Treasury debt, displacing the Japanese. More and more profligate authorities spending has pushed the federal debt increased than annual GDP, ad infinitum (Determine 1). What are we getting for this unprecedented debt? Largely, all it’s bought for us is political management which may solely charitably be characterised as mediocre.