It’s simple to be in denial about debt. However when anxiousness and worry take over, it might have an effect on extra than simply your monetary life. For those who really feel paralyzed by crushing debt, know that there’s a means out: chapter.

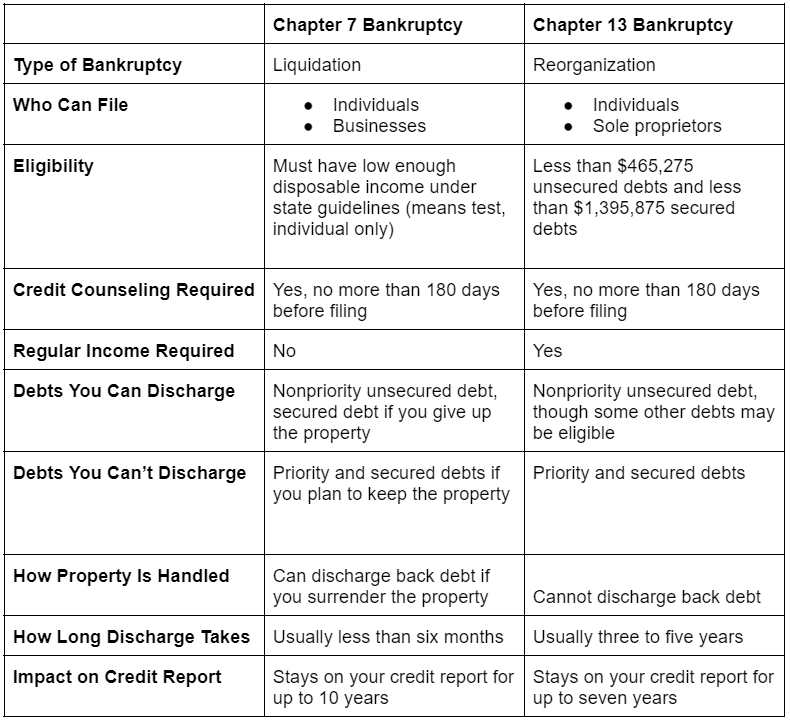

Whether or not you go for Chapter 7 or Chapter 13 chapter, it received’t be a simple highway. However it might provide help to regain management of your life and get again on stable monetary footing.

The way it works relies on which one you select. And which will rely in your particular person circumstances. So it pays to grasp the ins and outs of each earlier than deciding which one’s best for you.

Chapter 7 vs. Chapter 13 Chapter

Earlier than you file chapter, it’s very important to grasp that some money owed are handled in another way in chapter. Precedence money owed will stick round afterward, whether or not you select Chapter 7 or Chapter 13. For those who owe baby help or alimony or have tax debt or federal scholar loans, you may’t use chapter to eradicate them.

Motley Idiot Inventory Advisor suggestions have an common return of 618%. For $79 (or simply $1.52 per week), be part of greater than 1 million members and do not miss their upcoming inventory picks. 30 day money-back assure. Signal Up Now

Chapter additionally may not eradicate any secured money owed you may have. Secured money owed are something that’s backed by collateral, normally the factor you’re shopping for with the mortgage, equivalent to your mortgage funds or automotive loans.

That doesn’t imply you must give up your own home or automotive if you file chapter. As a substitute, you may proceed making funds on these money owed, although how that occurs relies on which kind of chapter you select. For those who nonetheless owe on them, you proceed to pay your secured loans after the chapter is over too.

In each instances, if you file for chapter, the court docket points an automated keep, which prevents your collectors or assortment companies from trying to gather your money owed. Each varieties of chapter may help you retain sure varieties of property and provide you with a little bit of respiratory room. Each additionally require credit score counseling not more than 180 days earlier than submitting.

However there are some essential variations between Chapter 7 and 13 chapter.

Chapter 7 Chapter – The Fast and Straightforward Choice

Chapter 7 is usually the faster and simpler possibility, because it’s normally over inside a couple of months and completely discharges any qualifying debt. It’s a liquidation chapter, that means the trustee would possibly promote (liquidate) your belongings to pay down your money owed. For those who solely have unsecured, nonpriority money owed and don’t have numerous belongings, Chapter 7 is normally the higher possibility.

Throughout Chapter 7, the chapter trustee, a person the court docket assigns to signify your property in chapter, can promote your belongings, whether or not they’re high-value objects like a ship or motorbike or lower-value objects like furnishings or designer clothes.

Chapter 7 does have revenue limits, so that you may not qualify if you happen to earn an excessive amount of or in case your debt-to-income ratio, the quantity of debt you owe versus how a lot you make expressed as a share of how a lot of your revenue goes towards money owed, isn’t excessive sufficient. That along with your loved ones dimension is what the federal government calls a “means check.”

Money owed you may discharge in Chapter 7 chapter embrace:

- Bank card debt

- Medical debt

- Previous-due lease

- Private loans

- Previous-due federal and state revenue taxes (at the least three years previous)

- Previous-due utility payments

- Previous-due legal professional’s charges

- Civil court docket judgments

Secured money owed, that are backed by property, equivalent to a automotive or home, get handled in another way in Chapter 7. You may discharge any again debt on them, supplied you hand over the collateral. If you wish to preserve the property related to secured money owed, it’s essential to reaffirm the debt and proceed making funds. You should be up-to-date on funds to take action.

For those who’re behind on secured money owed, there’s a danger of dropping the collateral (equivalent to your own home). Even if you happen to don’t discharge it, the trustee can promote it if there’s sufficient fairness constructed up.

However you would possibly qualify for an exemption, relying on the property sort. An exemption protects your property from collectors. However if you happen to owe loads, the exemption may not be sufficient to completely shield you.

There are a number of benefits to Chapter 7 chapter.

- You may wipe out unsecured money owed (and doubtlessly secured money owed), providing you with a contemporary begin.

- It occurs shortly, in as little as a couple of months.

- It will get collectors and assortment companies off your again.

However there are some important disadvantages you need to think about:

- The chapter trustee can promote sure possessions.

- You’re on the danger of a foreclosures on your own home or repossession of your automotive, because it doesn’t provide the choice to catch up if you happen to’ve fallen behind on funds.

- The chapter can keep in your credit score report for a decade.

- Your credit score rating will drop, although it is probably not that a lot and is likely to be preferable to debt.

Chapter 13 Chapter – Debt Reorganization and Fee Plan

For those who don’t qualify for Chapter 7, Chapter 13 is the way in which to go. Not like Chapter 7, Chapter 13 requires you to repay your money owed by means of a cost plan created by the chapter trustee. Chapter 13 is a reorganization chapter because the cost plan rearranges your money owed.

Observe that there’s a restrict to how a lot debt you may must qualify for Chapter 13. You should have lower than $465,275 in unsecured money owed and fewer than $1,395,875 in secured money owed.

The trustee will rank your money owed underneath the cost plan to make sure precedence money owed (equivalent to alimony) receives a commission in full by the point the plan is full (in three to 5 years). The plan can even account for secured money owed you may have and, if you happen to can afford to pay them, unsecured money owed. The quantity you pay underneath the cost plan is predicated in your month-to-month revenue.

Chapter 13 takes longer than Chapter 7, in some instances as much as 5 years. How lengthy relies on the reimbursement plan. In case your revenue is beneath the state’s median month-to-month revenue, your plan lasts three years. For those who earn greater than the state median revenue, it lasts 5 years.

Chapter 13 chapter helps you to discharge a couple of extra money owed than Chapter 7. The extra debt varieties you may discharge in Chapter 13 embrace:

- Money owed for malicious and willful damage to property (however to not an individual)

- Money owed to pay for nondischargeable tax obligations

- Money owed related to property settlements in a divorce or separation (aside from help obligations like alimony and baby help)

- Excellent money owed from a earlier chapter through which the court docket denied your discharge

- Retirement account loans

- Any householders affiliation or condominium charges due after your submitting date

- Sure noncriminal authorities fines and penalties

You could proceed making funds on secured money owed if you wish to preserve the property related to them. The good thing about Chapter 13 is that it means that you can reschedule the debt and doubtlessly scale back the worth of some property varieties, equivalent to a automotive.

With Chapter 13, you may proceed to make funds on secured money owed as soon as the cost plan is full. You don’t must pay them in full inside three to 5 years.

Whereas Chapter 13 doesn’t totally erase your debt, there are a number of causes folks usually view it extra favorably than Chapter 7.

- It creates a cost plan to make your debt extra manageable.

- It impacts your credit score rating lower than Chapter 7.

- You may preserve your own home and different belongings so long as you pay the money owed related to them.

- It will get collectors and assortment companies off of your again.

However there are nonetheless some important disadvantages.

- The method takes for much longer than Chapter 7.

- You might need problem making funds underneath your cost plan except you make and persist with a finances.

- The chapter will keep in your credit score report for seven years.

- Your credit score rating will drop, although it is probably not that a lot and it might be preferable to staying in debt.

Which Is Proper for You: Chapter 7 or Chapter 13 Chapter?

Whether or not it’s greatest to file Chapter 7 or 13 largely relies on your revenue and what varieties of debt you may have.

You Ought to File Chapter 7 Chapter If…

Total, Chapter 7 chapter is greatest for lower-income Individuals who’re in means over their heads. Chapter 7 chapter is a greater match if:

- Your Revenue Is Beneath the Median in Your State. You should go a way check to be eligible for Chapter 7. You robotically go the check if you happen to earn lower than the median month-to-month revenue in your state.

- You Don’t Have a Lot of Belongings. Your chapter trustee can promote your stuff to repay collectors throughout Chapter 7. Whereas there are exemptions, it’s normally higher for a debtor to not have numerous belongings or possessions once they file for Chapter 7 chapter.

- You Primarily Have Unsecured Money owed. For those who owe again taxes, alimony, baby help, or scholar loans, chapter received’t assist. You’re nonetheless on the hook if in case you have secured money owed and need to preserve the collateral. Chapter 7 isn’t a magical get-out-of-debt-free go. However if in case you have bank card debt, medical payments, or unsecured private loans, Chapter 7 may give you a contemporary begin.

- You Don’t Have Sufficient Disposable Revenue to Repay Your Money owed. You may go the means check even when your revenue is above the state median, supplied your disposable revenue (what’s left over after you pay for all of your mandatory bills) isn’t sufficient to cowl your month-to-month debt funds.

You Ought to File Chapter 13 Chapter If…

When you have ample revenue however nonetheless battle to make your funds, Chapter 13 is likely to be a greater match. Chapter 13 chapter is a greater match if:

- Your Revenue Is Above the State Median. To qualify for Chapter 13, it is advisable have an everyday revenue. For those who don’t go the means check for Chapter 7, Chapter 13 is likely to be your higher possibility.

- You Personal Your Dwelling or Automobile. Submitting Chapter 13 can preserve your own home out of foreclosures, as you may have the choice of catching up in your mortgage funds. You may also compensate for different varieties of secured debt, equivalent to your automotive mortgage.

- You Don’t Have Too A lot Debt. Chapter 13 has an unsecured debt restrict of $465,275

and a restrict of $1,395,875 for secured debt. For those who owe extra, Chapter 11, which is normally reserved for companies, is likely to be the higher alternative for you.

- You Can Afford the Month-to-month Fee. To get a discharge from Chapter 13, that means you’re freed from all of your unsecured money owed, it is advisable full your cost plan. Meaning you want to have the ability to afford the month-to-month cost. For those who imagine your revenue will stay regular sooner or later, you may really feel fairly good about submitting Chapter 13.

Last Phrase

Whether or not you find yourself submitting for Chapter 7 or Chapter 13, chapter isn’t one thing to hurry into. The chapter courts appear to acknowledge that, as all filers want to finish a credit score counseling course throughout which they study their debt reimbursement choices and punctiliously consider whether or not chapter is your best option earlier than they file.

However make sure you converse with a chapter legal professional to get a greater sense of what your chapter choices are first. It’s very troublesome to efficiently file chapter with out one.

Talking with a fiduciary monetary advisor may provide help to determine if Chapter 7 or 13 will present the aid you want or if one other debt aid possibility, equivalent to negotiating together with your lenders or getting on a debt administration plan, is the fitting alternative.