Like residential properties, quick time period industrial leases are an funding that gives you with a steady year-to-year earnings from actual property.

Industrial properties are an ideal automobile to diversify an actual property portfolio, and it’s a wonderful various to a residential property or an asset to an current actual property portfolio.

However, you must lease the industrial rental to a enterprise entity or a enterprise proprietor. A property will increase in worth if you happen to stack it with related facilities for a selected enterprise.

We ready this information that will help you navigate industrial leases. Preserve studying to seek out out what industrial leases are, find out how to spend money on them, and get probably the most out of your funding!

What Are Brief Time period Industrial Leases?

Industrial actual property (CRE) is a rental property you completely lease to companies. An instance of CRE is an workplace, warehouse, studio, or restaurant.

To grasp the attraction of a CRE, think about what it’s prefer to open an Italian restaurant positioned in a busy metropolis middle. It’s been round for just a few months, and it’s steadily rising. House owners needed to lease the place when beginning since they couldn’t afford it.

After they search for industrial area for lease, they take a look at facilities and kitchen tools. They spot a practical kitchen with a furnace to make pizzas and a kitchen in first rate situation. With small investments, the homeowners begin their restaurant, which is barely attainable if there’s a furnace.

Buyers in industrial leases improve the worth of their property with extra area of interest facilities. The aim of preliminary funding additionally guides your technique for working CRE. It drives the choice whether or not to lease for the long run or quick time period and find out how to handle your funding property.

Long run industrial leases are areas companies lease for at the least three to 5 years. Brief time period industrial leases are areas companies lease for a yr to 2 years. All of it goes again to what sort of return on funding (ROI) you wish to see out of your funding.

Associated: 7 Issues You Must Know About Industrial Actual Property

What Are the Execs and Cons of Investing in Industrial Leases?

Tenants search for industrial property for lease in identified enterprise facilities, purchaser’s markets, and tech hubs. An ideal instance of a enterprise middle and tech hub is Silicon Valley in San Francisco.

For the final 20 years, there was a excessive demand for industrial properties in Silicon Valley. New startups seem each day, and all they want is an workplace for as much as 5 folks, computer systems, and desks.

From an investor’s perspective, that’s at the least a year-long lease. If the corporate fails, the market is steady sufficient that you could be discover new tenants very quickly.

Your aim must be to discover a location with a rising inflow of individuals or a robust housing market. As soon as you discover it, you must discover ways to function quick time period industrial leases and purchase funding properties.

Execs of Investing in Brief Time period Industrial Leases

Execs of investing in brief time period industrial leases are flexibility, quick lease intervals, and excessive consumer turnover. With out micromanaging tenants, short-term CRE provides you a steady year-to-year earnings from a single property.

Take an workplace for instance. All companies want workplace area, even when they begin with a excessive failure chance. And, you can provide them a year-long lease for that essential interval within the lifetime of their firm. After half a yr, chat with the homeowners and see how the enterprise goes. Ask them in the event that they wish to lease it for an additional yr. When you get a detrimental response, then you can begin on the lookout for new tenants earlier than they vacate your property.

A smaller industrial property is ideal because it permits tenants to maneuver from it as they scale their enterprise. That additionally advantages you since your aim is a excessive consumer turnover with leases lasting at the least a yr.

Nevertheless, that’s too particular an instance because it begins with the concept that you’ve a small area to lease. It’s a lot completely different you probably have an even bigger property that enables you extra versatility and the next internet working earnings (NOI) from a single property.

Associated: 5 Inventive Methods to Enhance Rental Revenue from Actual Property

Cons of Investing in Brief Time period Industrial Leases

Cons of investing in brief time period CRE are the authorized issues and negotiations with tenants. Tenants could wish to negotiate greater than you might be keen to offer them.

Authorized points concern the phrases of the industrial lease. These phrases could embody taxes, insurance coverage, and using facilities. From the authorized perspective, it’s dangerous to method these issues with no lawyer or an agent.

When you have been to draft a lease with out skilled assist, you would possibly signal a contract on unprofitable phrases, which binds you to a contract lasting for a yr with no manner out.

With correct preparation, these are minor authorized inconveniences. The urgent difficulty must be discovering the best property. The ROI of business leases relies on their worth to the native companies.

ROI of Brief Time period Industrial Leases

To date, we’ve got mentioned what industrial leases are. However, most traders wish to know the ROI of the sort of funding. Brief time period CRE supplies a steady year-to-year earnings and a strong NOI.

Examine that with Airbnb leases that require a continuing stream of tenants. Industrial leases are contracts lasting at the least a yr. Whereas it’s not precisely passive earnings, it provides you stability and requires much less involvement than coping with tenants each day.

You might higher perceive CRE incomes prospects by evaluating month-to-month charges for conventional leases and Airbnb leases. You are able to do it if you happen to join for a 7-day free trial with Mashvisor, and evaluating these costs provides you an concept of what worth to set for the lease.

The issue you could encounter is that you just would possibly set a worth that seems to be unprofitable. And, if you happen to signed the lease, it’s not attainable to alter your month-to-month or yearly charge. Take a second to look at the distinction between these rental fashions.

Associated: What Is ROI in Actual Property? A Full Information

AirBnB vs Industrial Leases

The elementary distinction between Airbnb and industrial leases is within the authorized definition, and Airbnb falls within the class of residential leases, an area folks use for residing.

Airbnb isn’t a industrial rental until specified by the state the place it’s positioned. The final rule is that industrial leases are properties with the precise function of doing enterprise.

When it comes to return on funding, these are two distinct kinds of leases. Airbnb is simpler to scale, and there are numerous loans to help an Airbnb operation. Industrial leases are tougher to scale however present a year-long steady earnings, and they’re extra versatile and require much less work general.

Varieties of Industrial Leases

One other profit of business leases is that there are a number of kinds of CRE. The most well-liked varieties embody:

- Workplaces

- Warehouses

- Garages

- Restaurant areas

- Farmland

The most effective factor is that it’s attainable to switch any property for industrial functions. Turning an residence into an workplace is a comparatively frequent situation, and that technique works even higher if you happen to personal a small residence close to the town middle.

On this situation, the placement can be excellent for enterprise. A slight shade refresh with new carpets, desks, and chairs would make it interesting to potential tenants. After all, that’s if the kitchen and loo are practical. As a substitute of renovating the entire residence as you’d for AirBnB, you can take out the stuff and lease it to a small company or a lawyer.

On this situation, you can save on renovation prices and get a year-long settlement, and the tenants might cowl the upkeep bills.

How Mashvisor Can Assist You Reach Brief Time period Rental Funding

If, after studying this information, you suppose quick time period industrial leases are usually not for you, then contemplate investing in brief time period leases like Airbnb. Mashvisor may help you spend money on residential properties, which you’ll both lease out historically or on Airbnb. Its numerous instruments just like the rental property calculator will enable you to decide one of the best property for brief time period leases.

Seek for Funding Properties

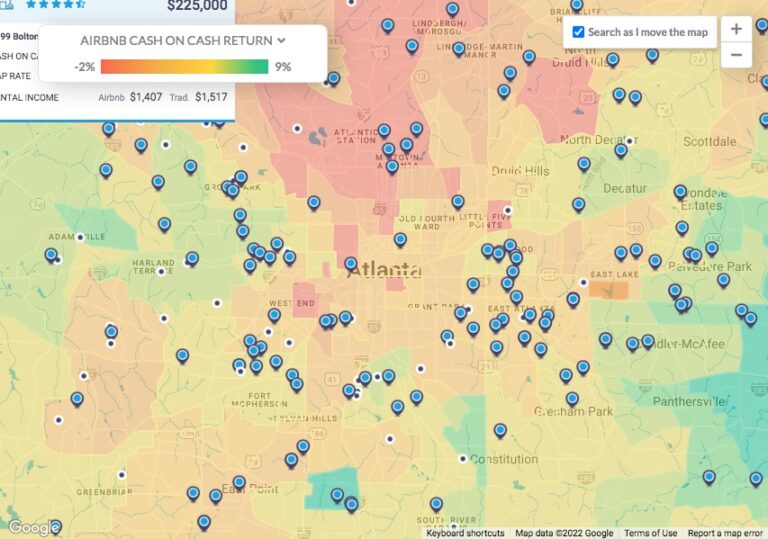

Every thing begins with a property search. Mashvisor lets you analysis areas and evaluate costs and metrics for Airbnb leases and conventional leases. A further instrument that will help you is the actual property heatmap.

The actual property heatmap instruments provide you with an perception into related investing areas. Once you use it, the instrument provides you the same really feel to a climate forecast displaying information in shade varieties. So, all the information you want for analysis is on the market from a easy search.

One other superior factor is that the heatmap instruments work for Airbnb leases as nicely. You additionally get entry to a wide range of information varieties, that are invaluable for newbie and skilled traders alike.

The information out there contains:

- Median Property Worth

- Common Worth per Sq. Foot

- Days on Market

- Variety of Conventional or Airbnb Listings

- Month-to-month Conventional or Airbnb Rental Revenue

- Conventional or Airbnb Money on Money Return

- Conventional or Airbnb Cap Fee

- Worth to Lease Ratio

- Airbnb Day by day Fee

- Airbnb Occupancy Fee (%)

- Stroll Rating

When you get all the information you want, export it as an inventory and use it for additional analysis. The one factor left for you is recognizing which information is effective for you and find out how to interpret it. After all, after getting extra expertise, you’ll be able to create your information units and concentrate on information for the precise kind of funding.

In any case, newbie traders usually take loans to finance their investments. So having a whole monetary projection is essential for the success of your funding.

When you determine that quick time period industrial leases are usually not for you, you can attempt investing in Airbnb leases as a substitute. Mashvisor’s actual property heatmap may help you discover an space in your metropolis that will be profitable to your chosen rental technique.

Use the Information

To raised perceive the information, please take a second to be taught extra about cap charge, return on funding, and charge of return. Understanding these phrases helps you higher perceive find out how to get the very best ROI out of your property.

Let’s return to the financing for a second. It’s uncommon to fulfill a newbie investor with sufficient capital to buy the property with money. Once you take a mortgage, you must pay the down cost and plan find out how to pay out the mortgage.

Utilizing the actual property heatmap, you get entry to related information like:

- Itemizing worth

- Conventional and Airbnb rental earnings

- Money on money return

- Airbnb occupancy charge

Collectively, the information presents you with the incomes potential of properties in a selected worth vary. When you have been to spend money on Airbnb leases, you wish to understand how a lot you’ll be able to earn out of your rental in a month and a yr.

Then, you get an outline of how a lot cash you internet monthly and yr. When you subtract it from the prices of proudly owning the rental, you get a exact estimate of the property’s ROI.

And you’ll look at all that earlier than even proudly owning the property! Information is probably the most highly effective instrument in your investing arsenal because it helps your funding technique all the way down to a molecule. Calculate the information and discover out immediately as a substitute of questioning whether or not you made the best resolution.

After all, studying extra about Airbnb leases and the short-term rental market is effective. As soon as you progress the information out of the way in which, managing an Airbnb rental turns into a lot enjoyable. It’s all about making one other individual really feel welcome in your property and giving them a visitor expertise they gained’t neglect.

Put money into Brief Time period Leases

Now what quick time period industrial leases are and find out how to spend money on them. However, they could be too overwhelming for a newbie investor. As a substitute, you’ll be able to attempt to spend money on quick time period leases like Airbnb.

Both manner, it’s greatest to begin by studying extra about actual property investing and inspecting information. Each can be found if you happen to join Mashvisor for a free trial.

With exact information, guides, and technique, beginning a worthwhile Airbnb enterprise might be a lot simpler. As a substitute of worrying an excessive amount of about companies, simply attempt to create an impressive visitor expertise. Add a number of financing choices and excessive ROI, and you’ve got an ideal funding selection for a first-time actual property investor.