Key takeaways

The softer market situations haven’t impacted all markets and worth segments equally.

Comparable tendencies may be seen throughout particular person capital cities.

Brisbane continues to face out amongst the capital metropolis markets.

Every of the remainder of the state markets recorded constructive unit worth progress over the quarter.

Nationwide unit rents rose 1.1% in March in comparison with a 0.3% rise in nationwide unit values.

The annual efficiency hole between homes and items fell additional this month (8.7%), as each markets slipped farther from their peak charge of progress recorded in January.

On the nationwide degree, items recorded a 0.3% rise in values over March, consistent with the expansion charges recorded in January and February, leading to a first-quarter appreciation of 0.9%.

That is equal to a $5,464 improve in median unit values by means of the quarter.

Nationwide home values rose 0.8% in March and a pair of.8% over the three months to March, thanks partially to robust progress in QLD and SA.

The rise in home values by means of the quarter was equal to an increase of $21,690 in median values.

Whereas nationwide homes are nonetheless recording stronger worth progress in comparison with items, homes have additionally recorded a quicker deceleration within the tempo of quarterly progress.

Since reaching a cyclical peak in Might 2021, the tempo of quarterly home progress has recorded a 4.9 share level fall, in comparison with a 3.8 share level fall for unit quarterly progress.

Equally, the slowdown in values may be seen within the annual progress pattern proven in Determine 1, with each homes and items transferring right into a downswing pattern after recording cyclical peaks in January.

Coming off the again of robust annual progress, affordability continues to be a key issue affecting market situations.

Amid greater inflation and the rising price of dwelling, potential patrons are discovering it tougher to save lots of for a deposit, whereas the quantity required for a deposit has additionally elevated.

Assuming a 20% deposit degree, the common home deposit has elevated by roughly $36,000 over the previous two years, whereas the everyday unit deposit has elevated by round $15,000.

As famous in earlier CoreLogic analysis, rising funding in greater density dwellings has a major position to play in assuaging affordability considerations, as a result of greater density housing is usually extra inexpensive.

Moreover, elevated housing density throughout key transport strains may also help maximise the effectivity and use of infrastructure.

The softer market situations haven’t impacted all markets and worth segments equally

Over the month of March, progress in homes was 0.5% throughout the mixed capital cities, outperforming items (which have been regular over the month).

Nevertheless, mixed regional home and unit values each recorded a month-to-month appreciation of 1.7%.

Whereas capital metropolis unit values remained flat over the month, the decrease quartile of unit values recorded a modest rise of 0.9%, whereas the center and higher segments recorded worth modifications of 0.2% and -0.5% respectively.

Traditionally, the higher quartile worth pattern has been extra unstable with greater peaks and deeper troughs.

Determine 2 reveals the rolling quarterly progress charge for mixed capital metropolis items by worth section.

Over the three months the March, higher quartile unit values fell by -0.7%, whereas the center and decrease quartiles each recorded constructive quarterly progress (0.5% and a pair of.4% respectively).

An analogous pattern may be seen throughout the person capital cities

Unit values are starting to file quarterly declines throughout the costlier cities of Sydney (-0.6%) and Melbourne (- 0.2%), whereas comparatively low cost cities like Brisbane and Adelaide are nonetheless recording quarterly progress above 4%.

With a median worth of $833,815, the everyday Sydney unit is roughly $355,000 greater than the everyday Brisbane unit, and greater than double the value of the common Adelaide unit.

On the suburb degree, 51.4% of Sydney’s unit markets analysed in CoreLogic’s Mapping the Market Report recorded a decline in values over the primary quarter, with numerous the most important falls recorded within the metropolis’s Northern Seashores area.

Throughout Melbourne, 58.0% of the unit markets analysed recorded a decline in values, with the most important worth declines recorded throughout the inner-city markets.

Brisbane continues to be the stand-out performer amongst the capital metropolis unit markets

Brisbane recorded a brand new cyclical excessive in month-to-month (1.6%), quarterly (4.6%), and annual progress charges (15.1%) in March.

The everyday Brisbane unit recorded a $63,000 rise in values over the previous 12 months.

Only one Brisbane suburb recorded a fall in unit values over the primary quarter of the 12 months.

Whereas Adelaide items proceed to file robust month-to-month progress charges, quarterly progress seems to be slowing, with the tempo of quarterly progress reducing from 4.4% in January to 4.2% over the three months to March.

Perth has recorded a shock reversal in its quarterly progress pattern, with the reopening of the WA border probably pushing unit values 0.7% greater over the three months to March.

Whereas quarterly progress has remained constructive throughout Hobart, Darwin, and Canberra, the tempo of progress continued to ease over March.

Regional unit markets proceed to indicate some resilience within the face of slowing market situations

Every of the ‘remainder of state’ markets recorded constructive unit worth progress over the quarter.

Regional Qld continued to guide the tempo of progress, recording a quarterly unit worth improve of 5.9%, adopted by regional WA (4.3%), regional Victoria (3.8%), and Regional NSW (3.6%).

On the different finish of the spectrum, regional SA items recorded the smallest improve in values, rising simply 0.5% over the quarter, whereas regional Tasmanian unit values rose by 1.7%.

Whereas month-to-month unit and home progress have been on par on the mixed regionals degree, 4 of the six ‘remainder of state’ areas recorded stronger unit progress than homes.

Together with affordability, variations in whole marketed unit provide proceed to be an necessary issue influencing deviating progress tendencies.

Over the 4 weeks to the tenth of April, nationwide unit listings have been -5.5% under the inventory ranges recorded this time final 12 months and -14.5% under the earlier five-year common.

Whereas nonetheless low, whole itemizing ranges have began to normalise in comparison with the volumes recorded in January, (-11.5% and -20.4%).

Whole itemizing provide ranges at the moment are above common in Sydney and Melbourne, whereas marketed unit stock stays tight throughout Brisbane, Adelaide, Hobart, Canberra, and the mixed regional unit market.

Because the tempo of worth progress continues to sluggish, rental progress is surging

Nationwide unit rents rose 1.1% in March in comparison with a 0.3% rise in nationwide unit values.

Persevering with the pattern seen all through the primary quarter of the 12 months, nationwide unit rents recorded the next month-to-month rental rise (1.1%) in comparison with homes (1.0%), leading to quarterly rental progress of three.0% and a pair of.4% respectively.

An analogous pattern can be seen throughout the mixed capitals, with capital metropolis items rising 3.1% over the primary quarter, in comparison with a 2.2% rise in home rents.

Capital metropolis unit rents at the moment are rising at their quickest quarterly charge since June 2008 (3.4%).

Unit rents rose throughout all capital metropolis and regional markets in March

That is aside from Darwin and regional SA which recorded a -0.6% and -0.3% rental discount.

Hobart and Regional Queensland led the tempo of unit hire progress, each recording a hire rise of 1.6%, adopted by Melbourne (1.3%) and Adelaide (1.3%).

Regardless of recording the strongest rental progress over the primary quarter, Melbourne unit rents are nonetheless -1.9% under their pre-COVID ranges.

Amongst the capitals, Sydney recorded the strongest annual progress charge (8.3%) over the 12 months to March, after a peak to trough fall of seven.2% within the first half of the pandemic.

Over the 12 months to March, Regional Tasmania (14.4%), Regional QLD (12.1%), and regional SA (11.2%) recorded the strongest unit rental progress, whereas Perth (5.7%) Darwin (5.8%) and Adelaide ( 6.6%) recorded the weakest.

Nationwide gross rental yields for items rose for the third consecutive month

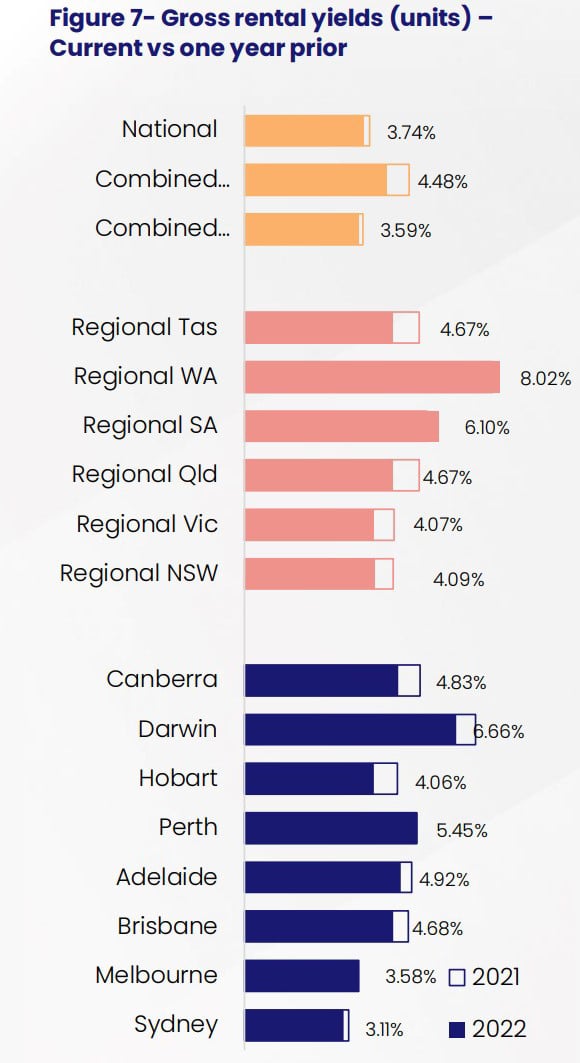

With hire progress persevering with to outpace worth appreciation, nationwide gross rental yields for items (3.74%) rose for the third consecutive month, up 8 basis points since bottoming out in December (3.66%).

Despite the recent rise, national unit yields are still 20 basis points below the yields recorded this time last year (3.74%).

Across the capital city markets, relatively affordable markets like Darwin (6.66%) and Perth (5.45%) continue to return the best rental yields among the capitals, while the more expensive market of Sydney (3.11%) and Melbourne (3.58%) continue to return the lowest.

Perth (5.45%), regional SA (6.10%) and regional WA (8.08%) are all now recording the strongest unit yields compared to this time last year, while Melbourne yields (3.58%) are in line with those recorded in March 2021.

Looking forward, appreciation of property values is seeing more headwinds than tailwinds, though the unit segment may be more resilient relative to houses as the Australian property market inches toward the downswing phase of the cycle.

Housing affordability constraints, rising mortgage rates, and the possibility of a lift in the cash rate over the next few months could see less buyer demand throughout the year.

However, unit capital growth cycles have historically seen less volatility than houses, and as a result, the downswing in prices is expected to be less than that in the detached house segment.

Unit stock is also generally more affordable relative to detached houses in the same area, and a downturn in demand may be partially offset by the fact that units are a more viable option amid housing affordability constraints.

Finally, it is clear that the investment proposition for units is becoming slightly more favourable in terms of rental return.

Unit rents are currently rising faster than capital growth, and faster than detached house rents.

Gross rental yields seem to have bottomed out in some cities and are now rising.

This may at least in part be due to relaxed restrictions around international travel earlier this year, where overseas arrivals tend to be renters, and tend to be concentrated in densely populated parts of cities.