UTI S&P BSE Low Volatility Index fund is the brand new issue index fund on the town.

Whereas it sounds counter-intuitive, we have now seen earlier that much less risky shares are inclined to do higher than extra risky shares.

There are a lot of Low Volatility Indices.

- Nifty Low Volatility Index (picks 50 least risky shares from the NSE-listed shares)

- Nifty 100 Low Volatility 30 (picks 30 least risky shares from Nifty 100)

- S&P BSE Low Volatility Index (picks 30 least risky shares from S&P BSE LargeMidcap)

Nifty 100 Low Volatility 30 picks from the universe of enormous cap shares, the opposite two indices choose shares from a a lot wider universe of shares.

There may be an ETF by ICICI monitoring Nifty 100 Low Volatility 30 index.

UTI and Motilal Oswal have launched index funds/ETFs monitoring S&P BSE Low Volatility index.

Which Low Volatility Issue Index is the very best?

I’d anticipate the efficiency to be related. Nonetheless, allow us to evaluate.

We evaluate the efficiency (Complete Returns index) from January 31, 2012, till January 31, 2022.

The S&P BSE Low Volatility Index is the very best performer on all parameters.

Highest CAGR.

Lowest commonplace deviation.

Larger Sharpe ratio and alphas.

Highest 3-year and 5-year common rolling returns.

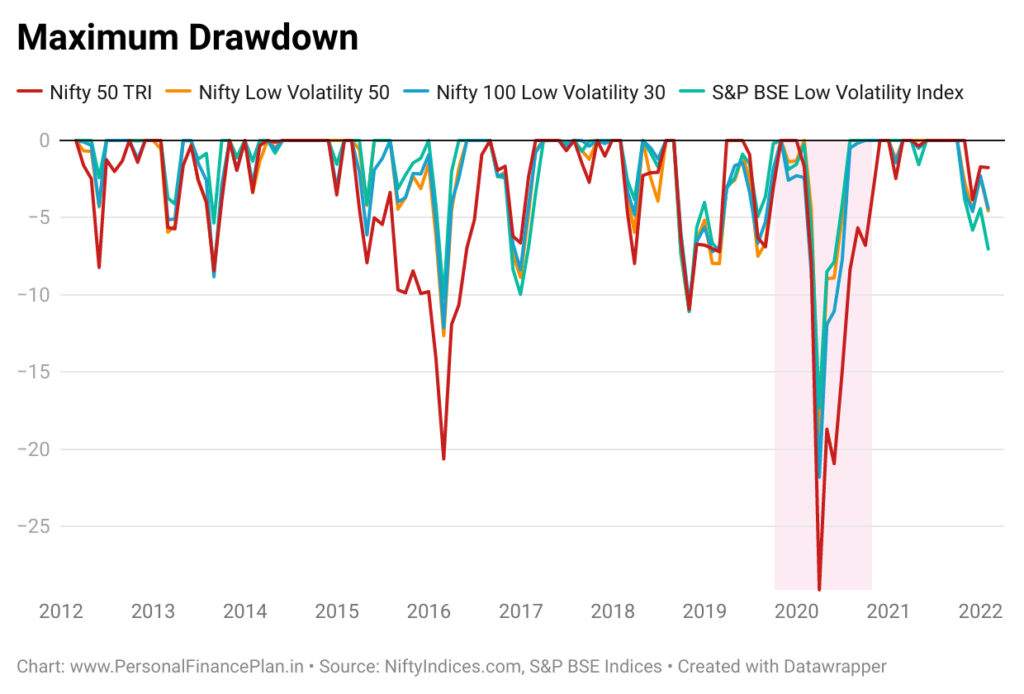

On the volatility entrance, you’d anticipate Low Volatility indices to carry out higher than Nifty 50. And the indices don’t disappoint. The drawdowns are decrease too.

What concerning the stay information?

Low volatility investing seems to be good. Nonetheless, not all of that is stay information. Information previous to the launch date is backfitted.

Listed here are the launch dates or numerous indices and the efficiency since launch.

As you possibly can see, Nifty 100 Low Volatility 30 and S&P BSE Low Volatility indices have underperformed Nifty 50 since their launch. Whereas these are point-to-point returns, 6 years continues to be a very long time.

You can even take a look at the rolling returns charts (shared earlier within the submit). With the stay information, the traces are a lot nearer to Nifty 50 (in comparison with back-fitted information).

Furthermore, observe these are Complete Return indices. There might be monitoring error. You’ll be able to anticipate larger monitoring error in Low volatility indices in comparison with Nifty 50. Even inside low vol indices, I’d anticipate larger monitoring error in Nifty Low Vol 50 and S&P BSE Low Vol index (because the universe of shares is broader).

Now, allow us to give attention to different efficiency parameters than simply returns (since July 31, 2016- January 31, 2022).

CAGR is decrease than CAGR for Nifty 50. Alpha has come down sharply (in comparison with numbers since Jan 31, 2012). Has virtually halved. Nonetheless, these indices nonetheless ship on their promise of low volatility. Regardless of decrease returns, Sharpe ratio is larger than Nifty 50. Common 3-year rolling returns are larger regardless of decrease CAGR. Decrease drawdowns. Good

I just like the Low Volatility issue. In my view, Low Volatility is the magic potion. Maybe as a result of junk shares (which we have now no dearth of) are usually extra risky. And Low volatility filter merely removes such shares.

Nonetheless, we’re demanding traders. Lesser volatility is okay however the place are the higher returns? And once you can not beat Nifty 50 over 5-6 years, the traders will ask questions.

Low Volatility has NOT been an impressive performer (returns), no less than based mostly on the stay information. Maybe, it delivers higher once you combine low volatility with different components. Now we have seen that in case of Alpha Low Volatility index and momentum indices.

Among the many Low Volatility indices, S&P BSE Low Volatility index is a high-quality selection.

Further Hyperlinks

S&P BSE Issue Indices Methodology

Nifty 100 Low Volatility 30 Index

Nifty Issue Indices Methodology