The Federal Reserve Financial institution of New York’s 2022 SCE Housing Survey reveals that anticipated adjustments in house costs within the yr forward elevated relative to the corresponding timeframe within the February 2021 survey, whereas five-year expectations remained unchanged. Households reported that they’d be much less seemingly to purchase in the event that they have been to maneuver in comparison with the year-ago survey, marking the primary annual decline because the collection started in 2014. This drop was pushed by present renters, who have been a lot much less seemingly to purchase in comparison with renters within the 2021 survey. Renters additionally reported that they count on rents to be sharply larger twelve months from now, with the anticipated price of enhance greater than twice that reported a yr in the past. The anticipated value of lease 5 years forward additionally rose in comparison with expectations a yr in the past, however at a extra reasonable tempo.

The SCE Housing Survey

This newest survey marks the ninth installment of the annual SCE Housing Survey, which has been fielded each February since 2014 and is a part of the broader Survey of Shopper Expectations. The 2022 survey consists of 1,242 respondents, about one-quarter of whom are present renters whereas the remaining three-quarters are householders. Outcomes are introduced within the SCE Housing Survey interactive net characteristic, which reveals time tendencies for variables of curiosity for the general pattern in addition to for numerous demographic teams, together with separate splits for homeowners and renters. For additional info on the SCE, please discuss with an overview of the survey methodology, the interactive chart information, and the survey questionnaire.

The first objective of the SCE Housing Survey is to supply wealthy, high-quality info on shoppers’ experiences, habits, and expectations associated to housing. The survey collects information on households’ perceptions and expectations for adjustments in house costs and rents, in addition to their intentions relating to shifting and shopping for sooner or later, perceptions of mortgage charges, and the convenience of acquiring a mortgage. The survey additionally elicits preferences for proudly owning and renting, and comprises geographic info to review variation in responses.

One-Yr Residence Value Expectations Speed up, 5-Yr Expectations Unchanged

Survey respondents estimated the worth of a typical house of their zip code and reported their anticipated worth of that house in a single and 5 years. The evolution of house value expectations, annualized on the five-year horizon, is proven within the chart beneath.

Households Anticipate Robust Residence Value Progress within the Brief Time period

The anticipated change in house costs over the subsequent yr rose relative to 12 months earlier, with households anticipating house costs of their zip code to rise by 7.0 p.c on common, in comparison with 5.7 p.c in February 2021. This enhance, regardless of an enhance in mortgage charges nationally since summer season 2021, displays robust momentum in house costs over the previous eighteen months. In distinction, five-year expectations remained unchanged, with households anticipating an annualized progress price of two.2 p.c. The divergence in one- and five-year expectations means that households foresee robust house value progress within the quick time period, however that costs will reasonable in the long run.

The divergence in households’ one- and five-year house value expectations was broad-based throughout age and training teams however was most pronounced for households with annual revenue of lower than $60,000. Regardless of vital outward migration from city facilities because the onset of the pandemic (Ramani and Bloom, 2021), city and rural households reported related house value expectations over the quick and medium time period. We additionally discovered no main variations within the short- and medium-term house value expectations between homeowners and renters.

The divergence of one-and five-year house value expectations is in keeping with households anticipating mortgage charges to proceed to extend within the close to time period. We requested respondents what they thought the typical mortgage rate of interest on a thirty-year fixed-rate mortgage was immediately, and what they thought it is going to be in a single and three years. Respondents reported larger one- and three-year anticipated mortgage charges relative to pre-pandemic ranges. The anticipated 8.23 p.c price in three years is the very best stage within the collection’ nine-year historical past.

Common Perceived Nationwide Mortgage Price

| | Feb 2020 | Feb 2022 |

|---|---|---|

| At present | 5.88 | 5.86 |

| In a single yr | 6.06 | 6.68 |

| In three years | 7.13 | 8.23 |

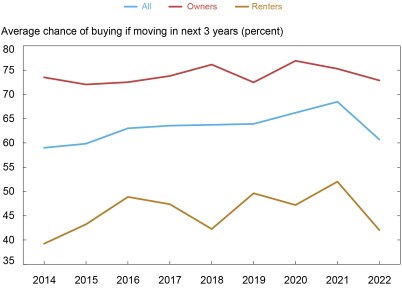

To evaluate whether or not the anticipated slowdown in house costs over the medium time period is because of a shift in attitudes relating to the attractiveness of housing as an funding, we requested respondents how seemingly they’d be to purchase versus renting in the event that they have been to maneuver over the subsequent three years. Households additionally reported that they’d be much less seemingly to purchase in the event that they have been to maneuver in comparison with a yr in the past. This was the primary annual decline on this collection because the survey started in 2014, and was pushed by present renters, who have been about 10 proportion factors much less seemingly to purchase in comparison with renters within the February 2021 survey. We additionally requested respondents how they seen the attractiveness of housing as an funding relative to different monetary investments. The fraction stating that housing is a “good” or “excellent” funding fell barely to 71.0 p.c, in comparison with its collection excessive of 73.6 p.c in February 2021.

Renters Are Much less Prone to Purchase if They Have been to Transfer in Subsequent Three Years

Renters Changing into Extra Pessimistic about Housing Market as Anticipated Rents Spike

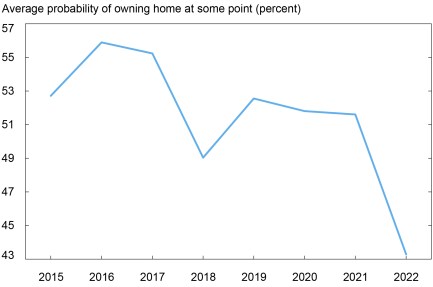

To know why renters report being much less seemingly to purchase in the event that they have been to maneuver, we requested how adjustments in house costs over the previous yr have affected their housing plans. Twenty-two p.c of households reported that they’d deliberate to buy a house however now view renting as a greater monetary choice. About 13 p.c of respondents acknowledged that the latest enhance in house costs had prompted them to hurry up their search to buy a house over the previous yr. Nonetheless, nearly all of respondents both most well-liked to lease (36 p.c) or mentioned they have been ready for costs to return down earlier than shopping for (42 p.c). We additionally requested renters how seemingly it was that they’d personal a house in some unspecified time in the future sooner or later. The common chance fell beneath 50 p.c for the primary time within the collection’ historical past.

Renters See a Decrease Probability of Ever Proudly owning a Residence

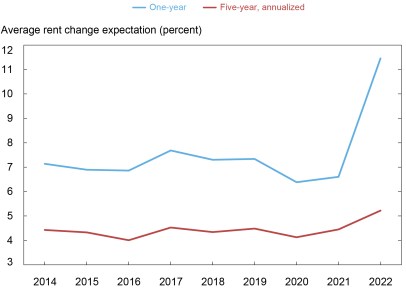

If renters beforehand on the margin of buying a house not discover homeownership as interesting, a key query turns into how are expectations of rental costs evolving? We requested respondents to estimate the rental worth of a typical house or residence of their zip code, and what they assume the lease will likely be one and 5 years from immediately.

Households Anticipate Massive Lease Will increase within the Brief Time period

Households count on a pointy rise in rents over the subsequent twelve months: on common, respondents count on rents to extend by 11.5 p.c, in comparison with 6.6 p.c within the February 2021 survey. This enhance was much more pronounced amongst present renters, who count on rents to rise by 12.8 p.c one yr from now in comparison with 5.9 p.c one yr in the past. That is in keeping with the concept that short-term lease expectations are being formed by the sharp will increase in lease which have occurred in latest months. The anticipated value of lease 5 years from now rose to an annualized enhance of 5.2 p.c, in comparison with 4.4 p.c a yr in the past.

Lastly, we’re additionally releasing a chart packet that describes our pattern and presents abstract statistics for a lot of extra questions that have been requested within the survey. This yr’s survey additionally included particular modules on local weather change and evictions, which we’ll write about within the close to future.

Fatima-Ezzahra Boumahdi is a senior analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Leo Goldman is a senior analysis analyst within the Financial institution’s Analysis and Statistics Group.

Andrew Haughwout is a senior vp within the Financial institution’s Analysis and Statistics Group.

Ben Hyman is an economist within the Financial institution’s Analysis and Statistics Group.

Haoyang Liu is a senior analysis economist on the Federal Reserve Financial institution of Dallas.

Disclaimer

The views expressed on this publish are these of the authors and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the authors.