U.S. inflation reached 7.9% final month, which is a 40 yr excessive and will value you as much as $4,800 a yr. That is the most important spike in inflation because the recession of 1982.

However that’s not all: the Federal Reserve is warning that these excessive costs are right here to remain for at the very least the subsequent three years.

My pocketbook hurts simply occupied with it.

What makes inflation so financially damaging is that for many of us, our incomes stay stagnant whereas prices skyrocket round us. In different phrases, every greenback you earn doesn’t go so far as it as soon as did.

The funds you created final month, not to mention final yr, is not related. With inflation, your earlier funds allocations may not be sufficient to your precise wants in the present day.

Whereas we are able to’t keep away from inflation, we are able to decrease the toll that it takes on our funds. Positive, the rising value of residing stings, nevertheless it doesn’t should sting that a lot. Under are 11 tricks to alter your funds for inflation!

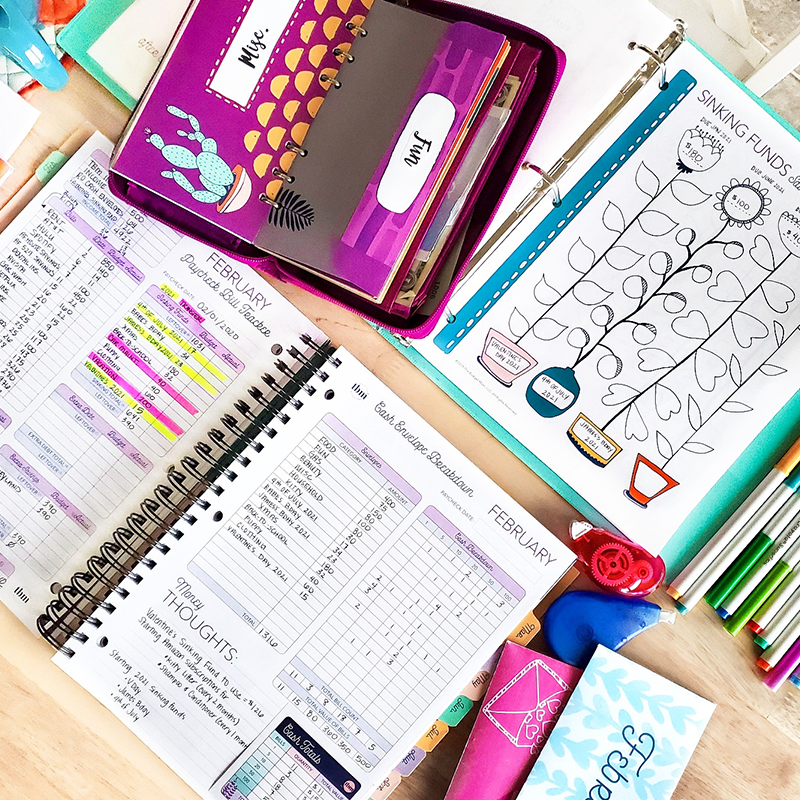

1. Tweak and Regulate Your Funds Each Single Month

Right here’s the factor about inflation: the economic system isn’t some monolithic creature that strikes at the very same tempo.

Some segments of the economic system (such because the inventory market) presently look like wonderful whereas others (corresponding to the auto trade) are dealing with extreme shortages.

As our value of residing inflates, it’s not going to take action concurrently throughout the board. Meals prices would possibly improve noticeably in a single month. If that’s the case, then adjusting your funds month-to-month helps you put together for these prices. Equally, as gasoline costs improve, chances are you’ll discover your electrical invoice beginning to go up.

Budgeting is rarely a one-time “set it and neglect it” kind of plan. It must be constantly evaluated and re-evaluated, particularly in occasions of financial uncertainty. Tweaking and adjusting your funds on a month-to-month foundation will assist you to keep on prime of inflation!

2. Lower Again in Different Areas of Your Life

If our baseline wants stay the identical however our greenbacks don’t go so far as earlier than, then we’re going to have to chop again on different areas in life,

I do know it’s not enjoyable to speak about, nevertheless it’s inevitable, so the actual fact of the matter is that one thing must be achieved.

Some areas are going to be extra apparent than others. For instance, when you’ve got a funds class for consuming out or for leisure, these may be areas the place you quickly reduce.

However, different alternatives for saving cash may not be as apparent and would possibly require some creativity. For those who’re a leisure runner, for instance, you would possibly quit registering for native races for the subsequent few months. Or in the event you bought hooked on grocery supply providers throughout the pandemic, maybe you make it some extent to buy in-person and save on supply charges.

3. Think about Altering Banks

Do you know that the typical rate of interest for a financial savings account is presently 0.06 %? Selecting a financial institution that gives greater rates of interest gained’t remedy inflation, nevertheless it does present a hedge towards it.

Nevertheless it’s not simply in regards to the rate of interest. Think about the next questions:

- Does my financial institution require month-to-month service charges?

- Can I simply entry my cash with Zelle and Invoice Pay?

- Is my cash FDIC insured?

- Does my financial institution have an app? Is it mobile-friendly?

These questions are all explanation why I like and personally suggest CIT Financial institution. The Financial savings Builder account helps you to earn as much as 0.45% APY, which is 7X the nationwide common charge! There are two methods to speed up your financial savings, and CIT Financial institution’s tiered platform helps inspire you to achieve your financial savings objectives.

4. Prioritize Your Debt

There’s by no means a superb time to fall behind on debt reimbursement, however there are most actually worse occasions than others, together with occasions of financial uncertainty.

Bear in mind, rates of interest on bank cards and loans “eat” away at your cash like inflation does. Right here’s the place issues can get very sticky: in the event you fall behind on debt reimbursement, some lenders cost hefty charges, even for only one missed invoice. Others would possibly even elevate your rate of interest.

Whereas we are able to’t management inflation, we do have some say over our rates of interest.

For those who’re combating bank card, scholar loans, your mortgage fee, or every other kind of debt, I like to recommend trying out a few of my earlier articles about debt and debt reimbursement methods.

5. Keep Conscious of Your Vitality Utilization

Tumultuous oil and gasoline costs are a significant driver of inflation. It’s simple to pigeonhole rising power prices and solely consider the ache on the pump. Nevertheless it’s not simply if you refill your tank. Excessive power prices additionally damage your funds as you warmth or cool your house.

Listed below are some tricks to decrease your power invoice with out feeling discomfort:

- Flip off the heater/air conditioner if you’re at work and the children are in school.

- Keep away from washing garments in sizzling water.

- Keep up-to-date on the climate and open the home windows on good days.

- Spend money on environment friendly gentle bulbs.

- Double-check the seals in your doorways and home windows.

These small modifications can add up and make an enormous distinction over time! Even when your month-to-month financial savings may not look like a lot, over the course of a yr, your funds will thanks!

6. Maintain Up with Retirement Financial savings

In terms of inflation, it’s tempting to solely take into consideration the right here and now.

Nevertheless it’s necessary to maintain your long-term objectives within the forefront of your thoughts. That is why creating and sticking to a funds is so necessary within the first place!

You see, when it’s time to chop again on expenditures, it’s arduous to surrender present pleasures corresponding to consuming out or leisure. As an alternative of reducing again on spending, some individuals make the error of reducing again on saving to be able to pay for elevated prices now.

Nonetheless, I encourage you to think about it this fashion: when it’s time to retire, issues are going to be much more costly. That’s how inflation works, and that’s simply the way in which it’s – so don’t cease investing. In reality, some individuals would possibly argue that saving is without doubt one of the few confirmed methods to actually combat inflation.

7. Think about Asking for a Elevate

Your boss may very well be an sudden supply of aid.

Throughout your annual overview, you could possibly point out the speed of inflation and use the economic system to justify a value of residing adjustment. Different components to contemplate embody, however aren’t restricted to:

- Optimistic evaluations or statements of reward from administration

- Knowledge-based accomplishments (e.g. elevated gross sales numbers or methods your saved the corporate cash)

- Analysis what related jobs within the market are providing

In case your boss refuses to funds, don’t be afraid to place out feelers for different alternatives. I promise you aren’t alone. The employment market has been evolving for a couple of years now, and the pandemic has actually accelerated a few of these modifications.

8. Begin a Aspect Hustle

Adjusting your funds for inflation doesn’t essentially imply it’s a must to reduce. Bear in mind, there are two sides to each funds: earnings and expenditures.

For those who don’t need to reduce in your expenditures, then the one different resolution is to extend your earnings. There are various explanation why you would possibly need to begin a facet hustle, together with to repay debt, save extra, develop wealth, or to be taught a brand new passion or ability. So why not additionally begin a facet hustle to maintain up with inflation?

To efficiently begin a facet hustle, I like to recommend:

- Beginning slowly so you may be taught, alter, and keep away from getting burnt out.

- Considering diligently about the precise facet hustle for you and your distinctive state of affairs.

- Charging what you’re price – unapologetically.

9. Keep Centered on Your Targets

Sticking to a funds is like sticking to a weight loss plan.

It’s simpler stated than achieved.

Generally the rationale it’s tough to stay to a funds is as a result of we view it strictly from an unemotional, mathematical perspective.

We neglect the rationale why we wish a wholesome funds within the first place, however with out a robust why, how can we anticipate ourselves to stay to the plan when the going will get robust?

Monetary achievement isn’t about having all the cash on the planet (although, wouldn’t that be good?). Fairly, it’s about having the liberty and stability of economic choices, which might solely come when you may have readability round what you need to accomplish.

Take the 2 minute quiz to learn the way shut you’re to monetary achievement. If you’d like the arrogance to belief your self in cash selections, you’ll need to take the quiz!

Ultimate Ideas

Life isn’t stagnant and neither is your funds. By adjusting your funds for inflation, you’re setting your self up for the longer term by minimizing monetary pitfalls that include unsure financial occasions.

In fact, staying motivated to remain on monitor isn’t at all times simple. For those who’re in search of a gaggle of like-minded and motivated individuals, I encourage you to affix The Funds Mother Household on Fb!