Shopify ( SHOP -5.06% ) not too long ago introduced a 10-for-1 inventory break up that can go into impact on June 28 for shareholders of document on June 22, assuming it passes shareholder approval. This implies Shopify’s present share value of $439.50 can be $43.95 after the break up.

Whereas the decrease share value may increase demand for the inventory, it will probably show momentary. What sustains long-term inventory value appreciation is enterprise efficiency. That’s the reason the current fall in Shopify’s share value looks as if an excellent shopping for alternative. Almost 600 million consumers transacted with Shopify retailers in 2021, which is a rise of 31% over 2020.

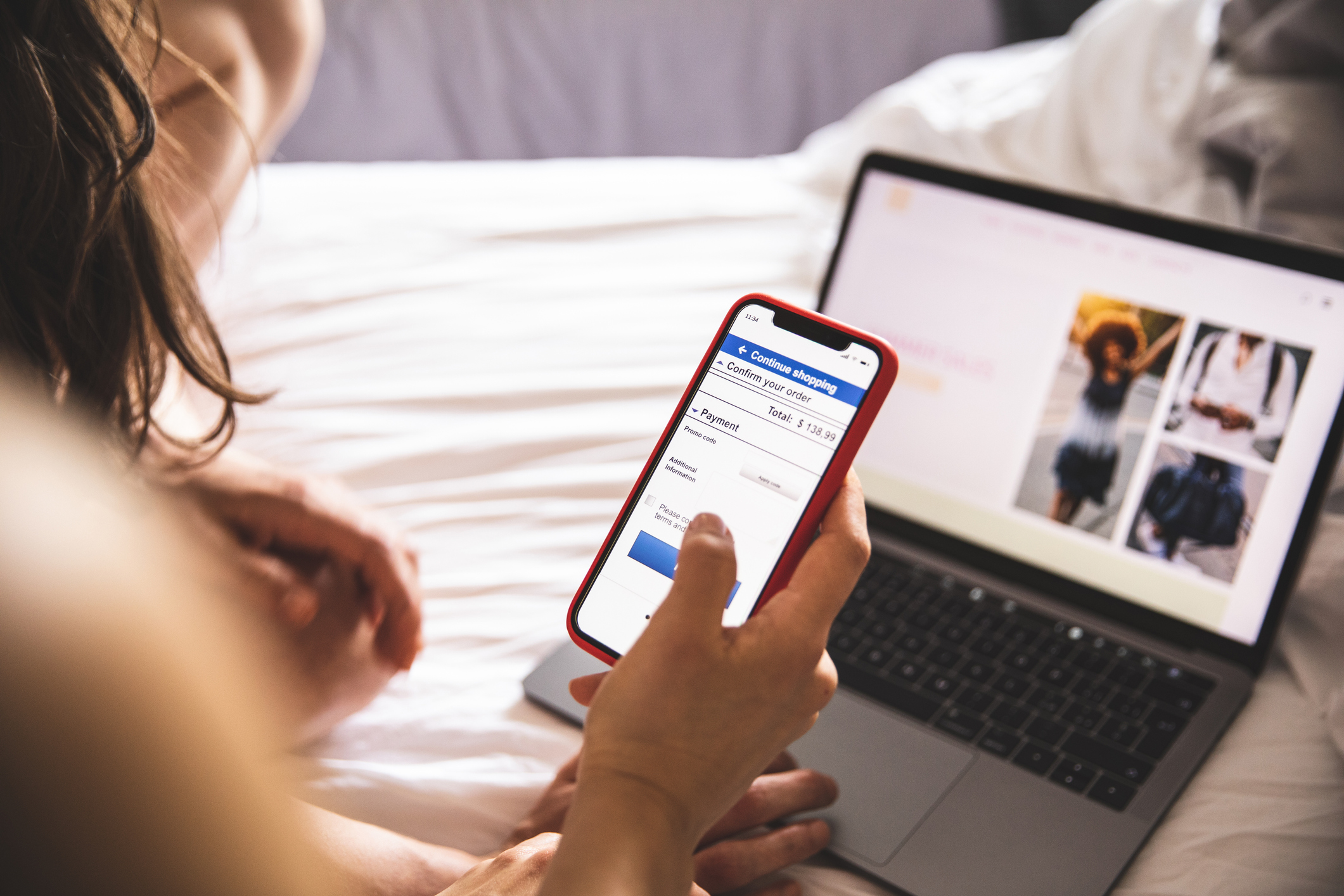

It appears virtually each on-line retailer I come throughout makes use of Shopify for the checkout course of, and that has me contemplating shopping for shares for at the very least three causes.

Picture supply: Getty Photos.

1. Sustained income progress

Shopify’s enterprise is simple to grasp. It makes cash from promoting subscriptions to instruments that assist companies open and handle on-line storefronts. Shopify gives extra providers — what the corporate calls service provider options — for cost processing (Shopify Funds), delivery and success, loans (Shopify Capital), and even apps via the Shopify App Retailer.

Competitors throughout e-commerce is growing, and that is one motive retailers are adopting Shopify. In 2021, income elevated 57% 12 months over 12 months to $4.6 billion, with most of that progress coming from service provider options. This implies companies are persevering with to undertake extra providers after subscribing, which speaks volumes about Shopify’s worth proposition.

SHOP Income (TTM) information by YCharts

2. Rising free money circulate

One knock towards Shopify has been that the enterprise would not report a revenue. Nonetheless, the expansion of higher-margin service provider options has reversed the corporate’s fortunes. For 2021, Shopify reported adjusted web earnings of $814 million, or $6.41 per share.

On a free money circulate foundation, which exhibits the precise amount of money the enterprise generated, Shopify additionally confirmed enchancment, going from damaging money technology to constructive over the previous couple of years.

SHOP Free Money Move information by YCharts

3. The inventory gives higher worth

Shopify’s enterprise is continuous to develop, and free money circulate is beginning to construct, which is nice to see. Bettering fundamentals make the inventory’s decrease price-to-sales (P/S) ratio very tempting, at the moment hovering simply above 12 instances gross sales. That’s rather more enticing than the 60 instances gross sales it bought for a 12 months in the past.

SHOP PS Ratio information by YCharts

What’s to not like? Income progress is anticipated to sluggish in 2022 because the pandemic-driven e-commerce surge begins to fade. Plus, competitors is intensifying. Amazon simply introduced the Purchase with Prime program, which expands quick supply and free delivery gives to retailers that promote utilizing Amazon, which might put Shopify within the tech titan’s crosshairs.

However once more, that is why buyers should buy Shopify at its most cost-effective valuation in three years. The inventory continues to be pretty costly, however because the valuation comes down, I am warming as much as the opportunity of beginning a place.

This text represents the opinion of the author, who might disagree with the “official” suggestion place of a Motley Idiot premium advisory service. We’re motley! Questioning an investing thesis – even certainly one of our personal – helps us all suppose critically about investing and make choices that assist us turn out to be smarter, happier, and richer.