Fairly a number of issues occurred in 1Q 2022.

Because the world continues to grapple with variants of COVID-19 with the newest being the Deltacron or the offspring of the Delta and Omicron variants, Russia determined to start out a warfare.

Inflation which was already gaining steam was pushed larger.

The Fed elevated rate of interest and there will probably be extra to return.

In an inflationary surroundings, we’ll see rising costs in commodities and we might see corporations like Wilmar doing higher.

In an surroundings of rising rates of interest, we might see banks doing higher.

and

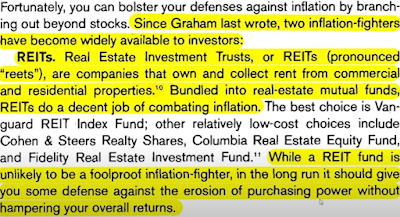

For many who are effectively learn, guess the place this passage got here from?

Anyway, common readers know that I did not do a lot within the inventory market final yr.

I really feel that, general, my funding portfolio is in fairly fine condition.

None of my investments which issues to me is retaining me up at night time.

(Solely Genshin Affect retains me up at night time now.)

Final yr, I added to my funding in Sabana REIT in early 2021 after which added to my funding in Wilmar as its inventory worth sank in 3Q 2021.

Nothing else.

So, I did not do a lot final yr however what about this yr to date?

Properly, I believed I would not be doing something in 1Q 2022 as a result of I moderately appreciated how my funding portfolio appeared.

As I didn’t purchase a lot of something within the inventory market in additional than a yr, my money pile has been rising at a gentle tempo which actually is not a foul factor.

Nevertheless, in direction of the top of 1Q 2022, I made a decision so as to add to my funding in Centurion Corp.

My funding in Centurion Corp. was already very substantial and I actually should not be including however I simply could not resist it.

So, I assume AK would not have as a lot character as he thought he had. (TmT)

There may be solely a small handful of people that every has 1 million or extra shares of Centurion Corp. and if I’m not cautious, I would be a part of their ranks.

Previous to 1Q 2022, the final time I added to my funding in Centurion Corp. was in 2020.

I ought to say “the previous couple of occasions” as a result of my data, there have been a number of entries made at 32c a share in 2020.

Why could not I resist including to my funding?

OK, I had a chat with my bowling ball and it had a number of issues to inform me.

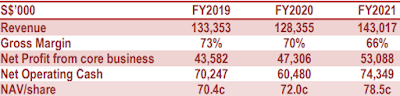

Centurion Corp. has weathered the pandemic effectively and has stayed worthwhile regardless of the challenges.

This speaks volumes.

Though it’s simply 0.5 cent per share, my bowling ball advised me that they may have simply paid 2 cents per share.

Actually?

See:

If we have a look at the numbers, internet working money not solely recovered however exceeded pre-pandemic degree.

Centurion Corp. was paying 2 cents dividend per share previous to the pandemic.

Then, why solely 0.5 cent dividend per share now?

My bowling ball was silent on this.

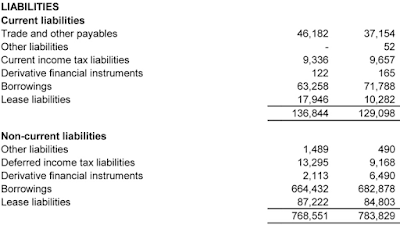

If I have been to make a guess, they’re in all probability being cautious which is not a foul factor, particularly in the event that they plan on paying down debt within the face of rising rates of interest.

their monetary assertion, Centurion Corp. diminished borrowings final yr when dividends have been suspended.

In fact, if they’ve recognized new companies which might generate extra earnings however want to draw on inside assets as an alternative of debt, it is not a foul thought both.

Centurion Corp. ought to pay a bigger dividend to shareholders in the event that they don’t have any higher use for the cash readily available.

Centurion Corp. has recovered effectively and appears to be as helpful an organization right now because it was pre-pandemic.

In actual fact, if we have a look at the NAV/share, it’s a lot larger than it was pre-pandemic which means that Centurion Corp. is much more helpful right now.

For the remainder of the yr, we might see Centurion Corp. doing higher as Singapore eases border restrictions and extra international staff return.

We will count on the occupancy of their dormitories for college kids within the UK, Australia and USA to do higher for the remainder of the yr too.

Their scholar lodging belongings within the UK have already seen a giant enchancment in occupancy.

Whereas the worth of its inventory languishes at the same time as issues enhance, it looks as if a very good alternative to extend my funding in Centurion Corp. and at an even bigger low cost to NAV too.

Centurion Corp. is undervalued however it might keep undervalued for a very long time.

It’d take some time however I prefer to assume that endurance will probably be rewarded.

Now, time for my passive earnings numbers.

In 1Q 2022, the three largest earnings turbines for me have been:

1. IREIT World

2. AIMS APAC REIT

3. Sabana REIT

S$ 40,697.68

In 1Q 2021, my passive earnings was $36,551.14 and that was some 48% larger than it was in 1Q 2020 as a consequence of bigger investments made in Sabana REIT and IREIT World.

So, the truth that 1Q 2022 passive earnings was some 11% larger than it was in 1Q 2021 makes me very blissful and the larger quantity is due to IREIT World’s stellar efficiency.

I like investing in good earnings producing belongings.

I like investing in them particularly if they’re undervalued.

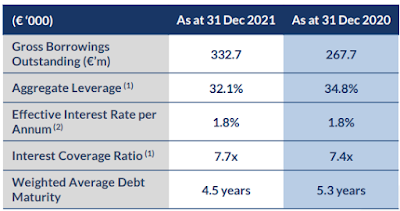

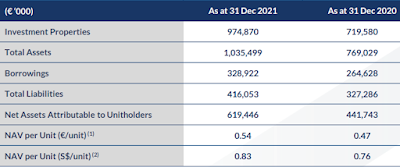

IREIT World not solely generates good earnings for me, the REIT can be financially sturdy which provides me peace of thoughts:

I’ve many blogs on IREIT World and if you’re , use the Search perform on the high of the online model of my weblog to seek out them.

There will not be any earnings distribution from IREIT World and Sabana REIT in 2Q 2022 however DBS, OCBC and UOB needs to be paying dividends then.

Will probably be fascinating to see if my passive earnings improves yr on yr in 2Q 2022 because the banks have been nonetheless paying decrease dividends in 2Q 2021.

1Q 2022 was crammed with unhealthy information and, for me, passive earnings was a brilliant spark amidst all of the doom and gloom.

If we maintain a comparatively diversified funding portfolio of bona fide earnings producing belongings, we must always take pleasure in some peace of thoughts even because the world appears greater than a bit tousled.

Maintain some funding grade bonds too and common readers know that the CPF does that for me.

I remind myself that I can solely do what I really feel is true as I hold my ft firmly on the bottom and never chase the newest get wealthy fast concepts.

If I’m able to develop my wealth slowly as a retiree who relies upon solely on passive earnings to fulfill all my monetary obligations, I’m blissful.

Make investments extra.

Speculate much less.

For certain, I wouldn’t have all of the solutions and I can solely hope for the most effective.

That is all for now.

Until the following weblog, keep secure.