At the moment the Authorities of India 10 Yrs Gsec is displaying a yield of 6.8%. Which is nearly round 1.3% greater than the SBI Financial institution FD fee for a similar tenure. Therefore, clearly, the query that can come up in our thoughts is – between 10 Yrs Govt Bond Yield 6.8% Vs 10 Yrs SBI Financial institution 5.5% FD, which is finest for us.

Allow us to perceive the positivity and negativity of each merchandise for higher decision-making.

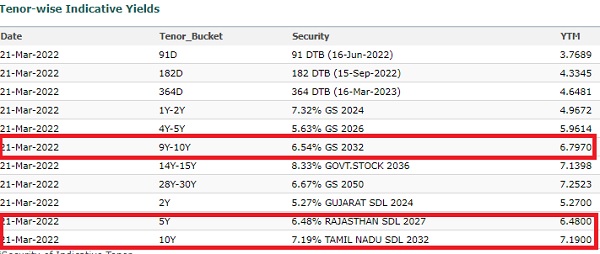

After the launch of RBI Retail Direct, many try to discover shopping for direct Authorities Of India Bonds or some SDLs additionally. Particularly within the case of SDLs, the yield is round 7%. Therefore, clearly, folks will suppose higher than typical nationalized financial institution FDs.

Nevertheless, the sport of investing in Financial institution FDs is completely different than the sport of investing immediately in Bonds.

10 Yrs Govt Bond Yield 6.8% Vs 10 Yrs SBI Financial institution 5.5% FD – Which one to take a position?

Right here, I’m not sharing the options of 10 Yrs 5.5% SBI Financial institution FD as you might all know the options of such merchandise. Therefore, my level is in direction of the 6.8% Authorities Of India Bond. See the under picture for the present yield of such Govt Bonds and even you seen that SDL gives a better yield.

# Fixed Stream of Revenue –

In case you are searching for some fixed stream of revenue as much as the maturity interval of the bond and determined to not promote through the bond interval, then clearly this appears to be top-of-the-line choices for you.

As present FD charges are under the ten 12 months Gsec Bond yield, higher you discover shopping for.

# Liquidity –

Retail participation continues to be not up to speed and I’m not positive whether or not you’ll be able to promote within the secondary market so simply. Regardless that the net platform is supplied by RBI by way of RBI Retail Direct, we now have to see the participation and volumes traded right here. Therefore, the danger of liquidating is at all times there.

# Security –

As you’re all conscious, the issuer is the Authorities Of India. Therefore, there isn’t a query of default or downgrade danger. Therefore, if somebody is searching for the most secure type of funding, then you’ll be able to discover.

# Volatility –

The present yield is for the present traders. As these bonds are extremely delicate to the rate of interest motion, volatility within the value of the bond is pure. Therefore, the yield may also fluctuate accordingly (Bond Worth and Yields are inversely proportional). In case you are able to digest such volatility, then enter (particularly the plan is to promote earlier than maturity).

# Taxation –

Taxation is yet one more hurdle with such bonds. The coupon (half-yearly curiosity) that you just obtain is taxable revenue for you.

Together with this, in the event you attempt to promote it within the secondary market and if there’s a capital achieve, then such achieve attracts the tax.

In case your holding interval is lower than a 12 months, then the achieve is taxed as per your revenue tax slab.

Nevertheless, in case your holding interval is greater than a 12 months, then it’s a must to pay 10% tax (with out indexation profit).

Therefore, such bonds are helpful for individuals who are within the decrease tax bracket relatively than for individuals who are within the greater tax bracket.

Conclusion – Simply because the yield is excessive in comparison with Financial institution FDs or different debt options doesn’t imply we blindly leap into shopping for. Such bonds are appropriate for individuals who are searching for a continuing stream of revenue and able to maintain as much as maturity. For others, who’re searching for a better yield, it’s a waste recreation contemplating the volatility, liquidity, taxation, and reinvestment danger of the coupon you obtain. Therefore, higher to keep away from such experiments. Somewhat, follow typical Financial institution FDs (if requirement is lower than 3 years), Cash Market or Extremely Brief Time period Bond Funds (if requirement is greater than 3 years however lower than 10 years) and in case your requirement is greater than 10 years, then you’ll be able to discover PPF, EPF, SSY, and Gilt Fixed Maturity Funds.